Market By Devices, End-users And Geography | Forecast 2019-2027

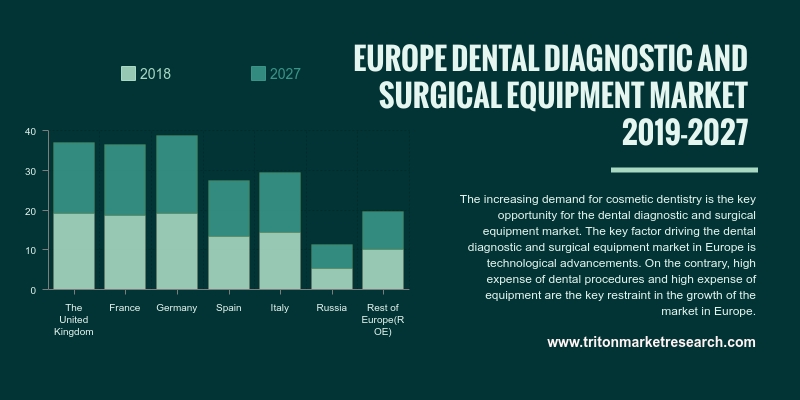

The Europe dental diagnostic and surgical equipment market is expected to proliferate at a growing trend with 6.29% of CAGR during the forecasting years 2019-2027.

The Europe market for dental diagnostic and surgical equipment has been segmented into various countries:

• The United Kingdom

• Germany

• France

• Italy

• Spain

• Russia

• Rest of Europe

Europe is projected to be the second-largest region for the dental diagnostics and surgical equipment market. In Europe, around 41% of people have natural teeth and the remaining have the artificial ones. The increasing healthcare spending is one of the major driving forces for the growth of the European market. The oral and dental expenditure accounts for 5% of the total expenditure on healthcare. The growth in the European market is attributable to the growing market in the UK, France and Germany.

Report scope can be customized per your requirements. Request For Customization

Germany is one of the fastest-growing country in the European region. The German dental diagnostic and surgical equipment market is uplifted by a number of factors such as the growing demand for corrective surgery, increased funding from the government & private organizations for developing oral & dental healthcare infrastructure and the rising development of VR in dentistry.

The UK holds the largest market share in the European market for dental diagnostics and surgical equipment. The large share of the UK in the dental diagnostics and surgical equipment market is majorly due to the increasing concern for health in this region. According to the Oral Health Foundation, the UK is the most likely nation for visiting a dentist in European nations. The growing oral health problems are one of the major concerns in the country due to the increasing consumption of tobacco and smoking in the region. Oral cancer is one of the major diseases caused due to oral health issues; the growing life expectancy is also one of the major driving forces for the dental diagnostics and surgical equipment market in the UK, which has given rise to the aging population in the region.

The companies mentioned in the dental diagnostic and surgical equipment market report are 3Shape, Carestream Health, Inc., Surgismith, Hu-Friedy Mfg. Co., Midmark Corporation, 3M Company, BIOLASE Technology, Inc., Qioptiq (acquired by Excelitas Technologies, Corp.), A-dec, ProMED, Inc., DentalEZ, Inc., Henry Schein, Inc., Dentsply International, DCI, GE Healthcare and Danaher Corporation.

1. DENTAL

DIAGNOSTIC AND SURGICAL EQUIPMENT MARKET - SUMMARY

2. INDUSTRY

OUTLOOK

2.1. MARKET

DEFINITION

2.2. PORTER’S

FIVE FORCES MODEL

2.2.1. THREAT

OF NEW ENTRANTS

2.2.2. THREAT

OF SUBSTITUTE PRODUCTS OR SERVICES

2.2.3. BARGAINING

POWER OF BUYER

2.2.4. BARGAINING

POWER OF SUPPLIER

2.2.5. INTENSITY

OF COMPETITIVE RIVALRY

2.3. MARKET

TRENDS

2.4. KEY

INSIGHTS

2.5. VALUE

CHAIN OUTLOOK

2.6. PATENTS

OUTLOOK

2.7. KEY

BUYING OUTLOOK

2.8. MARKET

DRIVERS

2.8.1. SIGNIFICANT

RISE IN DENTAL CLINICS

2.8.2. TECHNOLOGICAL

ADVANCEMENTS

2.8.3. RISE

IN THE AWARENESS

2.8.4. RISE

IN MEDICAL AND DENTAL TOURISM

2.9. MARKET

RESTRAINTS

2.9.1. HIGH

COST OF DEVELOPMENT

2.10.

MARKET CHALLENGES

2.10.1.

HIGH COST OF DENTAL PROCEDURES

2.10.2.

COST OF EQUIPMENT IS HIGH

2.11.

MARKET OPPORTUNITIES

2.11.1.

RISE IN DEMAND FOR COSMETIC

DENTISTRY

2.11.2.

INCREASE IN THE INNOVATION OF

NEW TECHNOLOGIES

3. DENTAL

DIAGNOSTIC AND SURGICAL EQUIPMENT MARKET OUTLOOK - BY DEVICE

3.1. INSTRUMENT

DELIVERY SYSTEM

3.2. CAD/CAM

SYSTEMS

3.2.1. FULL

IN-LAB SYSTEMS

3.2.2. STAND-ALONE

SCANNERS

3.2.3. CHAIRSIDE SYSTEMS

3.3. DENTAL

CHAIRS

3.4. DENTAL

RADIOLOGY EQUIPMENT

3.4.1. EXTRAORAL

RADIOLOGY EQUIPMENT

3.4.2. INTRAORAL

RADIOLOGY EQUIPMENT

3.4.3. CONE

BEAM COMPUTED TOMOGRAPHY SCANNERS

3.5. SCALING

UNIT MARKET

3.6. LIGHT

CURE EQUIPMENT

3.7. DENTAL

LASERS

3.7.1. SOFT

TISSUE LASERS

3.7.2. HARD/SOFT

TISSUE LASER

3.8. HANDPIECES

4. DENTAL

DIAGNOSTIC AND SURGICAL EQUIPMENT MARKET OUTLOOK - BY END-USERS

4.1. HOSPITALS

4.2. DENTAL

CLINICS

4.3. DIAGNOSTIC

CENTERS

4.4. OTHER END-USERS

5. DENTAL

DIAGNOSTIC AND SURGICAL EQUIPMENT MARKET - REGIONAL OUTLOOK

5.1. EUROPE

5.1.1. COUNTRY

ANALYSIS

5.1.1.1. UNITED

KINGDOM

5.1.1.2. FRANCE

5.1.1.3. GERMANY

5.1.1.4. SPAIN

5.1.1.5. ITALY

5.1.1.6. RUSSIA

5.1.1.7. REST

OF EUROPE

6. COMPETITIVE

LANDSCAPE

6.1. A-DEC

6.2. BIOLASE

TECHNOLOGY, INC.

6.3. GE

HEALTHCARE

6.4. MIDMARK

CORPORATION

6.5. PROMED,

INC.

6.6. CARESTREAM

HEALTH, INC.

6.7. DANAHER

CORPORATION

6.8. DCI

6.9. HU-FRIEDY

MFG. CO

6.10.

SURGISMITH

6.11.

QIOPTIQ (ACQUIRED BY EXCELITAS

TECHNOLOGIES CORP.)

6.12.

DENTALEZ, INC.

6.13.

3SHAPE

6.14.

DENTSPLY INTERNATIONAL

6.15.

HENRY SCHEIN, INC.

6.16.

3M COMPANY

7. METHODOLOGY

& SCOPE

7.1. RESEARCH SCOPE

7.2. SOURCES

OF DATA

RESEARCH METHODOLOGY

TABLE 1 EUROPE DENTAL DIAGNOSTIC AND SURGICAL

EQUIPMENT MARKET 2019-2027 ($ MILLION)

TABLE 2 PATENTS FOR DENTAL DIAGNOSTIC AND

SURGICAL EQUIPMENT

TABLE 3 AVERAGE COSTS OF DENTAL TREATMENTS ($)

TABLE 4 COST OF DENTAL SURGERY DEVICES ($)

TABLE 5 POPULATION PROJECTION

TABLE 6 EUROPE DENTAL DIAGNOSTIC AND SURGICAL

EQUIPMENT MARKET BY DEVICE 2019-2027 ($ MILLION)

TABLE 7 MERITS OF DELIVERY SYSTEMS

TABLE 8 EUROPE DENTAL DIAGNOSTIC AND SURGICAL

EQUIPMENT MARKET IN CAD/CAM SYSTEM BY TYPE 2019-2027 ($ MILLION)

TABLE 9 ADVANTAGES AND DISADVANTAGES OF

CHAIRSIDE CAD/CAM SYSTEM

TABLE 10 EUROPE DENTAL DIAGNOSTIC AND SURGICAL

EQUIPMENT MARKET IN DENTAL RADIOLOGY EQUIPMENT BY TYPE 2019-2027 ($ MILLION)

TABLE 11 CHOOSING THE RIGHT LIGHT SOURCE

TABLE 12 USAGE OF LASERS IN SOFT TISSUE SURGERY

TABLE 13 EUROPE DENTAL DIAGNOSTIC AND SURGICAL

EQUIPMENT MARKET BY END-USERS 2019-2027 ($ MILLION)

TABLE 14 EUROPE DENTAL DIAGNOSTIC AND SURGICAL

EQUIPMENT MARKET BY COUNTRY 2019-2027 ($ MILLION)

FIGURE 1 EUROPE DENTAL DIAGNOSTIC AND SURGICAL

EQUIPMENT MARKET 2019-2027 ($ MILLION)

FIGURE 2 EUROPE DENTAL DIAGNOSTIC AND SURGICAL

EQUIPMENT MARKET IN INSTRUMENT DELIVERY SYSTEM 2019-2027 ($ MILLION)

FIGURE 3 EUROPE DENTAL DIAGNOSTIC AND SURGICAL

EQUIPMENT MARKET IN CAD/CAM SYSTEMS 2019-2027 ($ MILLION)

FIGURE 4 EUROPE CAD/CAM SYSTEM MARKET IN FULL

IN-LAB SYSTEMS 2019-2027 ($ MILLION)

FIGURE 5 EUROPE CAD/CAM SYSTEM MARKET IN

STAND-ALONE SCANNERS 2019-2027 ($ MILLION)

FIGURE 6 EUROPE CAD/CAM SYSTEM MARKET IN CHAIRSIDE

SYSTEMS 2019-2027 ($ MILLION)

FIGURE 7 EUROPE DENTAL DIAGNOSTIC AND SURGICAL

EQUIPMENT MARKET IN DENTAL CHAIRS 2019-2027 ($ MILLION)

FIGURE 8 EUROPE DENTAL DIAGNOSTIC AND SURGICAL

EQUIPMENT MARKET IN DENTAL RADIOLOGY EQUIPMENT 2019-2027 ($ MILLION)

FIGURE 9 EXTRAORAL RADIOLOGY EQUIPMENT BY TYPE IN

2018 (%)

FIGURE 10 EUROPE DENTAL RADIOLOGY EQUIPMENT IN EXTRAORAL

RADIOLOGY EQUIPMENT 2019-2027 ($ MILLION)

FIGURE 11 INTRAORAL RADIOLOGY EQUIPMENT BY TYPE IN 2018

(%)

FIGURE 12 EUROPE DENTAL RADIOLOGY EQUIPMENT MARKET IN

INTRAORAL RADIOLOGY EQUIPMENT 2019-2027 ($ MILLION)

FIGURE 13 EUROPE DENTAL RADIOLOGY EQUIPMENT MARKET IN

CONE BEAM COMPUTED TOMOGRAPHY SCANNERS 2019-2027 ($ MILLION)

FIGURE 14 EUROPE DENTAL DIAGNOSTIC AND SURGICAL

EQUIPMENT MARKET IN SCALING UNIT 2019-2027 ($ MILLION)

FIGURE 15 EUROPE DENTAL DIAGNOSTIC AND SURGICAL

EQUIPMENT MARKET IN LIGHT CURE EQUIPMENT2019-2027 ($ MILLION)

FIGURE 16 EUROPE DENTAL DIAGNOSTIC AND SURGICAL

EQUIPMENT MARKET IN DENTAL LASERS 2019-2027 ($ MILLION)

FIGURE 17 EUROPE DENTAL LASERS MARKET IN SOFT TISSUE

LASERS 2019-2027 ($ MILLION)

FIGURE 18 CO2 LASER SOFT TISSUE APPLICATIONS

FIGURE 19 EUROPE DENTAL LASERS MARKET IN HARD/SOFT

TISSUE LASER 2019-2027 ($ MILLION)

FIGURE 20 EUROPE DENTAL DIAGNOSTIC AND SURGICAL

EQUIPMENT MARKET IN DENTAL HANDPIECES 2019-2027 ($ MILLION)

FIGURE 21 EUROPE DENTAL DIAGNOSTIC AND SURGICAL

EQUIPMENT MARKET IN HOSPITALS 2019-2027 ($ MILLION)

FIGURE 22 EUROPE DENTAL DIAGNOSTIC AND SURGICAL

EQUIPMENT MARKET IN DENTAL CLINICS 2019-2027 ($ MILLION)

FIGURE 23 EUROPE DENTAL DIAGNOSTIC AND SURGICAL

EQUIPMENT MARKET IN DIAGNOSTIC CENTERS 2019-2027 ($ MILLION)

FIGURE 24 EUROPE DENTAL DIAGNOSTIC AND SURGICAL

EQUIPMENT MARKET IN OTHER END-USERS 2019-2027 ($ MILLION)

FIGURE 25 UNITED KINGDOM DENTAL DIAGNOSTIC AND SURGICAL

EQUIPMENT MARKET 2019-2027 ($ MILLION)

FIGURE 26 FRANCE DENTAL DIAGNOSTIC AND SURGICAL

EQUIPMENT MARKET 2019-2027 ($ MILLION)

FIGURE 27 GERMANY DENTAL DIAGNOSTIC AND SURGICAL

EQUIPMENT MARKET 2019-2027 ($ MILLION)

FIGURE 28 SPAIN DENTAL DIAGNOSTIC AND SURGICAL

EQUIPMENT MARKET 2019-2027 ($ MILLION)

FIGURE 29 ITALY DENTAL DIAGNOSTIC AND SURGICAL

EQUIPMENT MARKET 2019-2027 ($ MILLION)

FIGURE 30 ITALY DENTAL DIAGNOSTIC AND SURGICAL

EQUIPMENT MARKET 2019-2027 ($ MILLION)

FIGURE 31 REST OF EUROPE DENTAL DIAGNOSTIC AND SURGICAL

EQUIPMENT MARKET 2019-2027 ($ MILLION)