Market By Types, End-users And Geography | Forecast 2019-2027

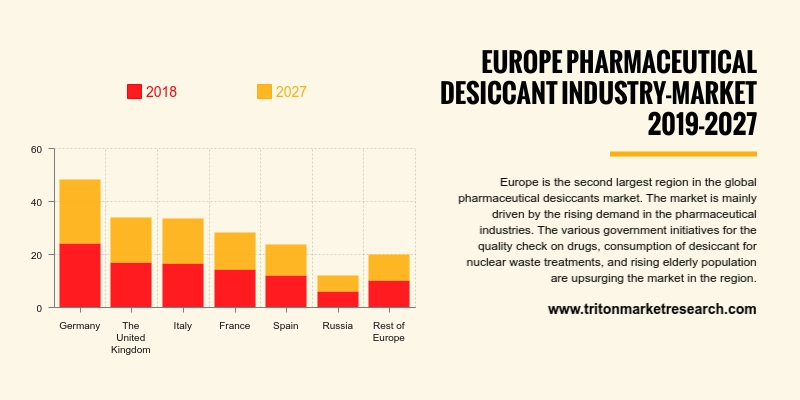

Research conducted by Triton represents that the Europe pharmaceutical desiccant market is expected to grow at a CAGR of 4.59% in terms of revenue over the forecast period 2019-2027.

The countries that have been analyzed in the Europe pharmaceutical desiccant market are:

• The United Kingdom

• Germany

• Italy

• France

• Spain

• Russia

• Rest of Europe

Report scope can be customized per your requirements. Request For Customization

The pharmaceutical desiccant market in Europe was the second-largest geographical market. Its market share was attributed to the increasing consumption of pharmaceutical desiccants in nuclear waste treatments, growth in the government support for the production of pharmaceutical desiccants and the abundance of natural pharmaceutical desiccant in Turkey and Russia. In Europe, Germany and the UK held the largest markets for pharmaceutical desiccants in 2015. The market growth in Europe is characterized by capacity expansions in the petrochemical industry in Azerbaijan, Germany, Russia and Kazakhstan. In Europe, especially in Russia, the market is expected to be fueled by the chemical, pharmaceutical, environmental clean-up, biohazard and liquid & gas dehydration applications.

In March 2018, Russian President Vladimir Putin stated that between 2019 and 2024, public healthcare expenditure should rise towards 5% of GDP, doubling from its current level. In February 2018, a draft amendment to the Law on the Circulation of Medicines concerning improvements to the state regulation of medicine prices was published. It was planned to enter into force in July 2018. According to the Minister of Industry and Trade, Sergey Tsyb, in February 2018, the key priorities of the Pharma 2030 plan which will continue from the Pharma 2020 plan have been set.

Other countries studied in the pharmaceutical desiccant market in Europe include Denmark, Sweden, the Netherlands, Switzerland, Belgium, among others. The growing consumer awareness, along with the increasing income and desire for convenience are the major drivers of the market in these countries. The ever increasing demand for pharmacy products is the primary factor contributing to the growth of the pharmaceutical desiccant market. Apart from this, the growing aging population and the increased adoption of pharmaceutical desiccants by them is another factor influencing the growth of the market.

Sanner GmbH is a German multinational company that offers packaging solutions to leading market players. Apart from Germany, the company has its presence in Indonesia, China, Hungary, India, France and the United States. In 2016, the company generated sales of approximately 64 million euros. In May 2017, Sanner completed the acquisition of Plastina Holding AG, the parent company of Jaco S.A., a Germany-based company.

1.

EUROPE PHARMACEUTICAL DESICCANT

MARKET - SUMMARY

2.

INDUSTRY OUTLOOK

2.1. MARKET DEFINITION

2.2. PORTER’S FIVE FORCES ANALYSIS

2.2.1.

THREAT OF NEW ENTRANTS

2.2.2.

BARGAINING POWER OF SUPPLIERS

2.2.3.

BARGAINING POWER OF BUYERS

2.2.4.

THREAT OF SUBSTITUTES

2.2.5.

COMPETITIVE RIVALRY

2.3. VENDOR SCORECARD

2.4. SUPPLY CHAIN ANALYSIS

2.5. KEY INSIGHT

2.6. MARKET DRIVERS

2.6.1.

GOVERNMENT INITIATIVES TAKEN TO ENSURE QUALITY OF DRUGS

2.6.2.

CONTINUOUS GROWTH IN THE PHARMACEUTICAL INDUSTRY

2.7. MARKET RESTRAINTS

2.7.1.

VARIABLE TEMPERATURES HAMPER PHARMACEUTICAL PRODUCTS

2.7.2.

STRINGENT REGULATIONS

2.8. MARKET OPPORTUNITIES

2.8.1.

ESTABLISHMENT OF STRONG PRESENCE IN VARYING CONSUMER PREFERENCES

2.9. MARKET CHALLENGES

2.9.1.

GROWING CUSTOMER EXPECTANCIES

2.9.2.

PRICING IS MARKET-BASED RATHER THAN COST-BASED

3.

PHARMACEUTICAL DESICCANT MARKET OUTLOOK - BY TYPES

3.1. SILICA GEL

3.2. ACTIVATED ALUMINA

3.3. CARBONCLAY DESICCANT

3.4. MOLECULAR SIEVES

3.5. OTHER TYPES

4.

PHARMACEUTICAL DESICCANT MARKET OUTLOOK - BY END-USER

4.1. TABLETS

4.2. APIs

4.3. CAPSULES

4.4. NUTRACEUTICAL PRODUCT PACKAGING

4.5. DIAGNOSTIC KITS

5.

PHARMACEUTICAL DESICCANT MARKET - REGIONAL OUTLOOK

5.1. EUROPE

5.1.1.

COUNTRY ANALYSIS

5.1.1.1.

GERMANY

5.1.1.2.

UNITED KINGDOM

5.1.1.3.

ITALY

5.1.1.4.

FRANCE

5.1.1.5.

SPAIN

5.1.1.6.

RUSSIA

5.1.1.7.

REST OF EUROPE

6.

COMPANY PROFILES

6.1. CAPITOL SCIENTIFIC, INC.

6.2. CLARIANT

6.3. CSP TECHNOLOGIES, INC.

6.4. DESICCARE, INC.

6.5. E. I. DU PONT DE NEMOURS AND COMPANY

6.6. MULTISORB TECHNOLOGIES

6.7. MUNTERS AB

6.8. OKER-CHEMIE GMBH

6.9. PROFLUTE AB

6.10.

ROTOR SOURCE, INC.

6.11.

SANNER GMBH

6.12.

W. R. GRACE & CO.

7.

METHODOLOGY AND SCOPE

7.1. RESEARCH SCOPE

7.2. SOURCES OF DATA

7.3. RESEARCH METHODOLOGY

TABLE

1 EUROPE PHARMACEUTICAL DESICCANT MARKET

2019-2027 ($ MILLION)

TABLE

2 EUROPE PHARMACEUTICAL DESICCANT MARKET

BY TYPES 2019-2027 ($ MILLION)

TABLE

3 EUROPE PHARMACEUTICAL DESICCANT MARKET

BY END-USERS 2019-2027 ($ MILLION)

TABLE

4 EUROPE PHARMACEUTICAL DESICCANT MARKET

BY COUNTRIES 2019-2027 ($ MILLION)

FIGURE

1 EUROPE PHARMACEUTICAL

DESICCANT MARKET 2019-2027 ($ MILLION)

FIGURE

2 PORTER’S FIVE FORCES ANALYSIS

OF EUROPE PHARMACEUTICAL DESICCANT MARKET

FIGURE

3 EUROPE PHARMACEUTICAL

DESICCANT MARKET IN SILICA GEL 2019-2027 ($ MILLION)

FIGURE

4 EUROPE PHARMACEUTICAL

DESICCANT MARKET IN ACTIVATED ALUMINA 2019-2027 ($ MILLION)

FIGURE

5 EUROPE PHARMACEUTICAL

DESICCANT MARKET IN CARBONCLAY DESICCANT 2019-2027 ($ MILLION)

FIGURE

6 EUROPE PHARMACEUTICAL

DESICCANT MARKET IN MOLECULAR SIEVE 2019-2027 ($ MILLION)

FIGURE

7 EUROPE PHARMACEUTICAL

DESICCANT MARKET IN OTHER TYPES 2019-2027 ($ MILLION)

FIGURE

8 EUROPE PHARMACEUTICAL

DESICCANT MARKET IN DESICCANT TABLETS 2019-2027 ($ MILLION)

FIGURE

9 EUROPE PHARMACEUTICAL

DESICCANT MARKET IN API 2019-2027 ($ MILLION)

FIGURE

10 EUROPE PHARMACEUTICAL

DESICCANT MARKET IN DESICCANT CAPSULES 2019-2027 ($ MILLION)

FIGURE

11 EUROPE PHARMACEUTICAL

DESICCANT MARKET IN NUTRACEUTICAL PRODUCTS PACKAGING 2019-2027 ($ MILLION)

FIGURE

12 EUROPE PHARMACEUTICAL

DESICCANT MARKET IN DIAGNOSTIC KITS 2019-2027 ($ MILLION)

FIGURE

13 GERMANY PHARMACEUTICAL DESICCANT

MARKET 2019-2027 ($ MILLION)

FIGURE

14 UNITED KINGDOM PHARMACEUTICAL

DESICCANT MARKET 2019-2027 ($ MILLION)

FIGURE

15 ITALY PHARMACEUTICAL DESICCANT

MARKET 2019-2027 ($ MILLION)

FIGURE

16 FRANCE PHARMACEUTICAL

DESICCANT MARKET 2019-2027 ($ MILLION)

FIGURE

17 SPAIN PHARMACEUTICAL DESICCANT

MARKET 2019-2027 ($ MILLION)

FIGURE

18 RUSSIA PHARMACEUTICAL

DESICCANT MARKET 2019-2027 ($ MILLION)

FIGURE 19 REST

OF EUROPE PHARMACEUTICAL DESICCANT MARKET 2019-2027 ($ MILLION)