Market By End-user, Derivatives And Geography | Forecast 2019-2027

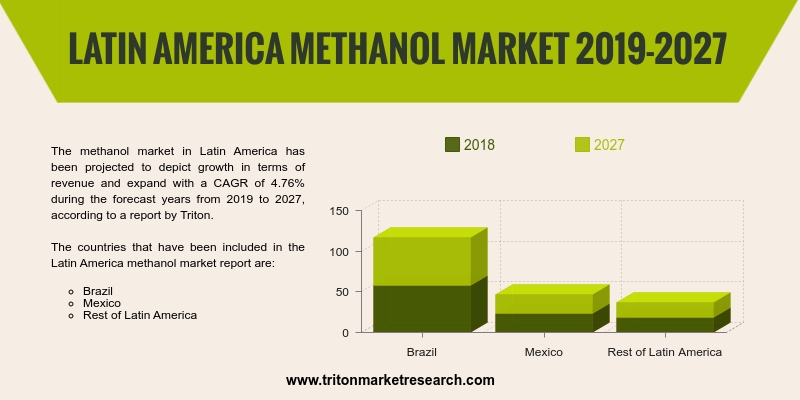

The methanol market in Latin America has been projected to depict growth in terms of revenue and expand with a CAGR of 4.76% during the forecast years from 2019 to 2027, according to a report by Triton.

The countries that have been included in the Latin America methanol market report are:

• Brazil

• Mexico

• Rest of Latin America

Report scope can be customized per your requirements. Request For Customization

Latin America is one of the top-growing markets in the bio/pharmaceutical industry. Even in the pesticides market, Latin America has seen the strongest growth in the last decade. This shift was supported by the increased efficiency in biopesticides and the growing consumer confidence in their performance. Also, the region offers huge potential in the automotive industry as the car ownerships are low and the disposable incomes are relatively higher than in the Asia-Pacific region. Thus, the methanol market is expected to grow to a certain extent. Though the other countries in the region are not well developed, the increasing trend of environment awareness coupled with the growing adoption of cost-effective options among end-users industries in the region is expected to boost the studied market over the forecast period.

Ethanol’s higher energy density as compared to methanol while still being a liquid makes it an attractive alternative. In many countries, it is used as a common additive to fuels. Brazil is the world's largest producer of ethanol. In Brazil, petrol contains a minimum 25% of ethanol by law and as many as 17.3 million vehicles use 100% ethanol (called neat ethanol) as a fuel. Thus, the use of ethanol proves to be a restraint for the growth of the methanol market.

Biorefining appears to have a powerful grip on the economy with the enhancements in technology. The expeditious growth of biorefining results in the increase in the capacity of production of renewable chemicals in the methanol market in the next five-to-six years. The economic competitiveness of biorefining and increase in consumer demands for renewable goods is pulling this market. Various alternatives are used in Brazil as technological advancements such as the production of chemicals platform biorefineries through biomass-to-liquid technology (BLT). Apart from this, it accounts for more efficient reuse of biomass regarding sustainability, logistics and markets.

The players leading the methanol market are BASF AG, Teijin, Methanex Corporation, Celanese Corporation, Petroliam Nasional Berhad (PETRONAS), Valero Marketing and Supply Company, Qatar Fuel Additives Company Limited, Methanol Holdings (Trinidad) Limited (MHTL), Mitsui & Co., Ltd., Mitsubishi Chemicals, Saudi Basic Industries Corporation and Zagros Petrochemical Company (ZPC).

1.

LATIN AMERICA METHANOL MARKET

- SUMMARY

2.

INDUSTRY OUTLOOK

2.1. MARKET DEFINITION

2.2. KEY INSIGHTS

2.2.1. AUTOMOTIVE SECTOR HOLDS THE LARGEST MARKET

SHARE

2.2.2. FORMALDEHYDE IS WIDELY USED DERIVATIVE OF

METHANOL

2.3. PORTER’S FIVE FORCE ANALYSIS

2.3.1. THREAT OF NEW ENTRANTS

2.3.2. THREAT OF SUBSTITUTE

2.3.3. BARGAINING POWER OF SUPPLIERS

2.3.4. BARGAINING POWER OF BUYERS

2.3.5. INTENSITY OF COMPETITIVE RIVALRY

2.4. MARKET ATTRACTIVENESS INDEX

2.5. VENDOR SCORECARD

2.6. MARKET DRIVERS

2.6.1. RISING ACCEPTANCE OF THE MTO TECHNOLOGY

2.6.2. RISE IN THE DEMAND FOR PETROCHEMICALS

2.6.3. NEED FOR CONVENTIONAL TRANSPORTATION FUELS

2.6.4. PROMOTION OF METHANOL AS AN ALTERNATIVE FUEL

BY THE GOVERNMENT

2.7. MARKET RESTRAINTS

2.7.1. SCARCITY OF RAW MATERIALS

2.7.2. USE OF FUEL GRADE ETHANOL OR BIOETHANOL

INSTEAD OF METHANOL

2.8. MARKET OPPORTUNITIES

2.8.1. INCREASE IN THE DEMAND FOR BIO-BASED PRODUCTS

2.8.2. DEVELOPMENT IN TECHNOLOGY FOR THE BIOREFINING

2.8.3. APPLICATION OF METHANOL AS A MARINE FUEL

2.9. MARKET CHALLENGES

2.9.1. UNSTABLE METHANOL PRICES

2.9.2. ECONOMIC SLOWDOWN HINDERS THE DEMAND FOR

METHANOL

2.9.3. REGULATIONS AND POLICIES

3.

METHANOL MARKET OUTLOOK - BY END-USER

3.1. AUTOMOTIVE

3.2. CONSTRUCTION

3.3. ELECTRONICS

3.4. PAINTS AND COATINGS

3.5. OTHER END-USERS

4.

METHANOL MARKET OUTLOOK - BY DERIVATIVES

4.1. FORMALDEHYDE

4.2. ACETIC ACID

4.3. GASOLINE

4.4. DME

4.5. MTBE & TAME

4.6. OTHER DERIVATIVES

5.

METHANOL MARKET - LATIN AMERICA

5.1. BRAZIL

5.2. MEXICO

5.3. REST OF LATIN AMERICA

6.

COMPETITIVE LANDSCAPE

6.1. BASF AG

6.2. CELANESE CORPORATION

6.3. QATAR FUEL ADDITIVES COMPANY LIMITED

6.4. METHANOL HOLDINGS (TRINIDAD) LIMITED (MHTL)

6.5. METHANEX CORPORATION

6.6. MITSUBISHI CHEMICALS

6.7. MITSUI & CO., LTD.

6.8. PETROLIAM NASIONAL BERHAD (PETRONAS)

6.9. SAUDI BASIC INDUSTRIES CORPORATION

6.10.

TEIJIN

6.11.

VALERO MARKETING AND SUPPLY COMPANY

6.12.

ZAGROS PETROCHEMICAL COMPANY (ZPC)

7.

METHODOLOGY & SCOPE

7.1. RESEARCH SCOPE

7.2. SOURCES OF DATA

7.3. RESEARCH METHODOLOGY

TABLE 1: LATIN AMERICA

METHANOL MARKET, BY GEOGRAPHY, 2019-2027 (IN $ MILLION)

TABLE 2: MARKET

ATTRACTIVENESS INDEX

TABLE 3: VENDOR

SCORECARD

TABLE 4: LATIN AMERICA

METHANOL MARKET, BY COUNTRY, 2019-2027 (IN $ MILLION)

TABLE 5: LATIN AMERICA

METHANOL MARKET, BY END-USERS, 2019-2027 (IN $ MILLION)

TABLE 6: LATIN AMERICA

METHANOL MARKET, BY DERIVATIVES, 2019-2027 (IN $ MILLION)

FIGURE 1: LATIN AMERICA

METHANOL MARKET, BY END-USER, 2018 & 2027 (IN %)

FIGURE 2: LATIN AMERICA

AUTOMOTIVE MARKET FOR METHANOL, 2019-2027 (IN $ MILLION)

FIGURE 3: LATIN AMERICA

FORMALDEHYDE MARKET, 2019-2027 (IN $ MILLION)

FIGURE 4: PORTER’S FIVE

FORCE ANALYSIS

FIGURE 5: LATIN AMERICA

METHANOL MARKET, BY AUTOMOTIVE, 2019-2027 (IN $ MILLION)

FIGURE 6: LATIN AMERICA

METHANOL MARKET, BY CONSTRUCTION, 2019-2027 (IN $ MILLION)

FIGURE 7: LATIN AMERICA

METHANOL MARKET, BY ELECTRONICS, 2019-2027 (IN $ MILLION)

FIGURE 8: LATIN AMERICA

METHANOL MARKET, BY PAINTS AND COATINGS, 2019-2027 (IN $ MILLION)

FIGURE 9: LATIN AMERICA

METHANOL MARKET, BY OTHER END-USERS, 2019-2027 (IN $ MILLION)

FIGURE 10: LATIN

AMERICA METHANOL MARKET, BY FORMALDEHYDE, 2019-2027 (IN $ MILLION)

FIGURE 11: LATIN

AMERICA METHANOL MARKET, BY ACETIC ACID, 2019-2027 (IN $ MILLION)

FIGURE 12: LATIN

AMERICA METHANOL MARKET, BY GASOLINE, 2019-2027 (IN $ MILLION)

FIGURE 13: LATIN

AMERICA METHANOL MARKET, BY DME, 2019-2027 (IN $ MILLION)

FIGURE 14: LATIN

AMERICA METHANOL MARKET, BY MTBE & TAME, 2019-2027 (IN $ MILLION)

FIGURE 15: LATIN

AMERICA METHANOL MARKET, BY OTHER DERIVATIVES, 2019-2027 (IN $ MILLION)

FIGURE 16: LATIN

AMERICA METHANOL MARKET, REGIONAL OUTLOOK, 2018 & 2027 (IN %)

FIGURE 17: BRAZIL

METHANOL MARKET, 2019-2027 (IN $ MILLION)

FIGURE 18: MEXICO

METHANOL MARKET, 2019-2027 (IN $ MILLION)

FIGURE 19: REST OF

LATIN AMERICA METHANOL MARKET, 2019-2027 (IN $ MILLION)