Market By Blood Type, Application, End-users And Geography | Forecast 2019-2027

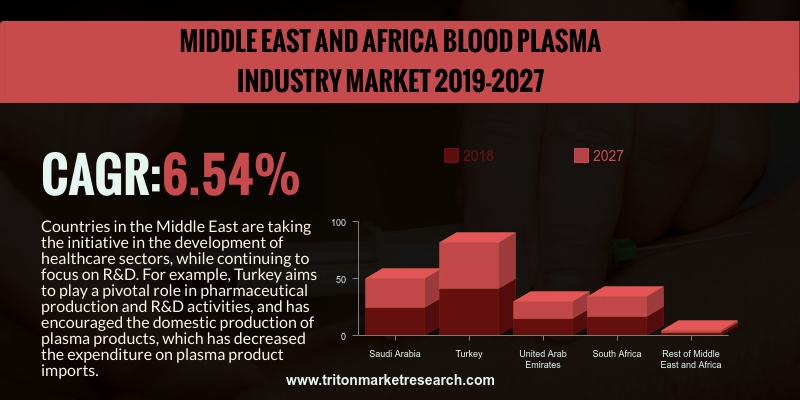

Triton’s report on the Middle East and Africa blood plasma market suggests that it will upsurge with a CAGR of 6.54% in the forecasting duration of 2019-2027.

The countries that have been included in the report on the Middle East and Africa’s blood plasma market are:

• Saudi Arabia

• Turkey

• The United Arab Emirates

• South Africa

• Rest of the Middle East & Africa

Countries in the Middle East are taking the initiative in the development of healthcare sectors, while continuing to focus on R&D. For example, Turkey aims to play a pivotal role in pharmaceutical production and R&D activities, and has encouraged the domestic production of plasma products, which has decreased the expenditure on plasma product imports. In 2014, research was conducted on the potential of platelet-rich plasma (PRP) for the treatment of immature teeth. The study was conducted on an immature tooth with periapical lesions using a regenerative approach involving PRP therapy. The study concluded that the platelet-rich plasma approach can be effectively applied in regenerative endodontic therapies. PRP therapy has also been employed in hair transplantation procedures in clinics in Turkey. For example, MCAN Health is one of the most influential clinics in Istanbul with expertise in hair transplantation, plastic surgery, dental treatment and eye surgery. Plasma is isolated from the patient’s own blood and then injected into the scalp. The demand for PRP has increased since it is for a non-surgical procedure that does not induce an allergic reaction post-application. An increase in the consumption of blood products, specifically plasma, was observed during the Ebola outbreak that hit the African region from 2014 to 2016. The primary concern regarding blood plasma therapies in this region is safety and efficacy during blood transfusions, which is hampering the growth in this region. Additionally, the limited adoption of new technologies limits their demand.

Cerus Corp. manufactures biomedical products for blood transfusion safety. The company designed the INTERCEPT blood system to ensure safe procedures by decreasing the risk of infections transmitted via blood transfusions. The system functions through a nucleic acid-targeting mechanism, which inactivates any pathogens present in the blood. Cerus Corp. markets and sells the INTERCEPT system for platelets and plasma-derived from human blood. The company provides the blood system in various parts of the world, including the U.S., Europe and certain countries in the Middle East.

1.

MIDDLE EAST AND AFRICA BLOOD PLASMA MARKET - SUMMARY

2.

INDUSTRY OUTLOOK

2.1. MARKET DEFINITION

2.2. PORTER’S FIVE FORCES OUTLOOK

2.2.1.

THREAT OF NEW ENTRANTS

2.2.2.

THREAT OF SUBSTITUTES

2.2.3.

BARGAINING POWER OF BUYERS

2.2.4.

BARGAINING POWER OF SUPPLIERS

2.2.5.

THREAT OF RIVALRY

2.3. VENDOR SCORECARD

2.4. CLINICAL GUIDELINES

2.5. REGULATION IN THE PLASMA THERAPEUTICS

2.6. KEY INSIGHTS

2.7. MARKET TRENDS

2.8. MARKET DRIVERS

2.8.1.

EXPANSION IN INDICATION FOR NEW THERAPEUTIC AREAS

2.8.2.

APPROVAL OF IMMUNOGLOBULIN-CENTERED THERAPIES

2.8.3.

SURGE IN THE HEMOPHILIA TREATMENT

2.9. MARKET RESTRAINTS

2.9.1.

HIGH COSTS OF BLOOD PLASMA TREATMENTS

2.9.2.

EASY AVAILABILITY OF RECOMBINANT PLASMA

2.10.

MARKET OPPORTUNITIES

2.10.1.

INCREASING PUBLIC COGNIZANCE

2.10.2.

RISE IN THE PLASMA-DERIVED PRODUCTS OPPORTUNITIES

2.10.3.

INCREASING OCCURRENCE OF HEMOPHILIA

2.11.

MARKET CHALLENGES

2.11.1.

SPREAD OF PATHOGENIC CONTAMINANTS

2.11.2.

HIGH REGULATIONS IN THE MARKET

2.12.

BLOOD PLASMA INDUSTRY BY MODE OF DELIVERY

2.12.1.

INFUSION SOLUTIONS

2.12.2.

GELS

2.12.3.

SPRAYS

2.12.4.

BIOMEDICAL SEALANTS

3.

BLOOD PLASMA MARKET OUTLOOK - BY BLOOD TYPE

3.1. ALBUMIN

3.2. IMMUNOGLOBULIN

3.2.1.

INTRAVENOUS IMMUNOGLOBULIN

3.2.2.

SUBCUTANEOUS IMMUNOGLOBULIN

3.2.3.

OTHER IMMUNOGLOBULIN TYPE

3.3. COAGULATION FACTOR CONCENTRATES

3.4. HYPERIMMUNES

3.5. OTHER PLASMA FRACTIONATION PRODUCTS

4.

BLOOD PLASMA MARKET OUTLOOK - BY APPLICATION

4.1. ONCOLOGY

4.2. HEMATOLOGY

4.3. TRANSPLANTATION

4.4. RHEUMATOLOGY

4.5. NEUROLOGY

4.6. IMMUNOLOGY

4.7. PULMONOLOGY

4.8. OTHER APPLICATIONS

5.

BLOOD PLASMA MARKET OUTLOOK - BY END-USER

5.1. ACADEMIC INSTITUTIONS

5.2. RESEARCH LABORATORIES

5.3. HOSPITALS AND CLINICS

6.

BLOOD PLASMA MARKET - REGIONAL OUTLOOK

6.1. COUNTRY ANALYSIS

6.1.1.

SAUDI ARABIA

6.1.2.

TURKEY

6.1.3.

THE UNITED ARAB EMIRATES

6.1.4.

SOUTH AFRICA

6.1.5.

REST OF MIDDLE EAST & AFRICA

7.

COMPANY PROFILES

7.1. SHIRE PLC

7.2. ARTHREX

7.3. OCTAPHARMA AG

7.4. BAXTER INTERNATIONAL, INC.

7.5. GRIFOLS INTERNATIONAL S.A.

7.6. BIOTEST AG

7.7. CSL LTD.

7.8. ADMA BIOLOGICS, INC.

7.9. CHINA BIOLOGIC PRODUCTS, INC.

7.10.

GENERAL ELECTRIC CO.

7.11.

CERUS CORP.

8.

METHODOLOGY & SCOPE

8.1. RESEARCH SCOPE

8.2. SOURCES OF DATA

8.3. RESEARCH METHODOLOGY

TABLE 1 MIDDLE EAST AND

AFRICA BLOOD PLASMA MARKET 2019-2027 ($ MILLION)

TABLE 2 BLOOD PLASMA

COMPONENTS

TABLE 3 MIDDLE EAST AND

AFRICA BLOOD PLASMA MARKET BY BLOOD TYPE 2019-2027 ($ MILLION)

TABLE 4 MIDDLE EAST AND

AFRICA BLOOD PLASMA MARKET IN IMMUNOGLOBULIN BY TYPES 2019-2027 ($ MILLION)

TABLE 5 PROTEASE INHIBITORS

USED IN THE HIV INFECTION TREATMENT

TABLE 6 MIDDLE EAST AND

AFRICA BLOOD PLASMA MARKET BY APPLICATION 2019-2027 ($ MILLION)

TABLE 7 MIDDLE EAST AND AFRICA

BLOOD PLASMA MARKET BY END-USER 2019-2027 ($ MILLION)

TABLE 8 MIDDLE EAST AND

AFRICA BLOOD PLASMA MARKET BY COUNTRY 2019-2027 ($ MILLION)

FIGURE 1 MIDDLE EAST AND

AFRICA BLOOD PLASMA MARKET 2019-2027 ($ MILLION)

FIGURE 2 IMMUNOGLOBULIN

INFUSIONS SIDE-EFFECTS

FIGURE 3 ROLE OF FIBRIN

SEALANT IN COAGULATION CASCADE

FIGURE 4 MIDDLE EAST AND

AFRICA BLOOD PLASMA MARKET IN ALBUMIN 2019-2027 ($ MILLION)

FIGURE 5 MIDDLE EAST AND

AFRICA BLOOD PLASMA MARKET IN IMMUNOGLOBULIN 2019-2027 ($ MILLION)

FIGURE 6 MIDDLE EAST AND

AFRICA IMMUNOGLOBULIN MARKET IN INTRAVENOUS IMMUNOGLOBULIN 2019-2027 ($

MILLION)

FIGURE 7 MIDDLE EAST AND

AFRICA IMMUNOGLOBULIN MARKET IN SUBCUTANEOUS IMMUNOGLOBULIN 2019-2027 ($

MILLION)

FIGURE 8 MIDDLE EAST AND AFRICA

IMMUNOGLOBULIN MARKET IN OTHER IMMUNOGLOBULIN TYPE 2019-2027 ($ MILLION)

FIGURE 9 MIDDLE EAST AND

AFRICA BLOOD PLASMA MARKET IN COAGULATION FACTOR CONCENTRATES 2019-2027 ($

MILLION)

FIGURE 10 HYPERIMMUNES ISOLATION

PROCESS

FIGURE 11 MIDDLE EAST AND AFRICA

BLOOD PLASMA MARKET IN HYPERIMMUNES 2019-2027 ($ MILLION)

FIGURE 12 MIDDLE EAST AND AFRICA

BLOOD PLASMA MARKET IN OTHER PLASMA FRACTIONATION PRODUCTS 2019-2027 ($

MILLION)

FIGURE 13 MIDDLE EAST AND AFRICA

BLOOD PLASMA MARKET IN ONCOLOGY 2019-2027 ($ MILLION)

FIGURE 14 MIDDLE EAST AND AFRICA

BLOOD PLASMA MARKET IN HEMATOLOGY 2019-2027 ($ MILLION)

FIGURE 15 MIDDLE EAST AND AFRICA

BLOOD PLASMA MARKET IN TRANSPLANTATION 2019-2027 ($ MILLION)

FIGURE 16 LUPUS INFECTION

SYMPTOMS

FIGURE 17 MIDDLE EAST AND AFRICA

BLOOD PLASMA MARKET IN RHEUMATOLOGY 2019-2027 ($ MILLION)

FIGURE 18 MIDDLE EAST AND AFRICA

BLOOD PLASMA MARKET IN NEUROLOGY 2019-2027 ($ MILLION)

FIGURE 19 MIDDLE EAST AND AFRICA

BLOOD PLASMA MARKET IN PULMONOLOGY 2019-2027 ($ MILLION)

FIGURE 20 MIDDLE EAST AND AFRICA

BLOOD PLASMA MARKET IN IMMUNOLOGY 2019-2027 ($ MILLION)

FIGURE 21 MIDDLE EAST AND AFRICA

BLOOD PLASMA MARKET IN OTHER APPLICATIONS 2019-2027 ($ MILLION)

FIGURE 22 MIDDLE EAST AND AFRICA

BLOOD PLASMA MARKET IN ACADEMIC INSTITUTIONS 2019-2027 ($ MILLION)

FIGURE 23 MIDDLE EAST AND AFRICA

BLOOD PLASMA MARKET IN RESEARCH LABORATORIES 2019-2027 ($ MILLION)

FIGURE 24 MIDDLE EAST AND AFRICA

BLOOD PLASMA MARKET IN HOSPITALS AND CLINICS 2019-2027 ($ MILLION)

FIGURE 25 SAUDI ARABIA BLOOD

PLASMA MARKET 2019-2027 ($ MILLION)

FIGURE 26 TURKEY BLOOD PLASMA

MARKET 2019-2027 ($ MILLION)

FIGURE 27 THE UNITED ARAB

EMIRATES BLOOD PLASMA MARKET 2019-2027 ($ MILLION)

FIGURE 28 SOUTH AFRICA BLOOD

PLASMA MARKET 2019-2027 ($ MILLION)

FIGURE 29 REST OF MIDDLE EAST

& AFRICA BLOOD PLASMA MARKET 2019-2027 ($ MILLION)