Market By End-user, Derivatives And Geography | Forecast 2019-2027

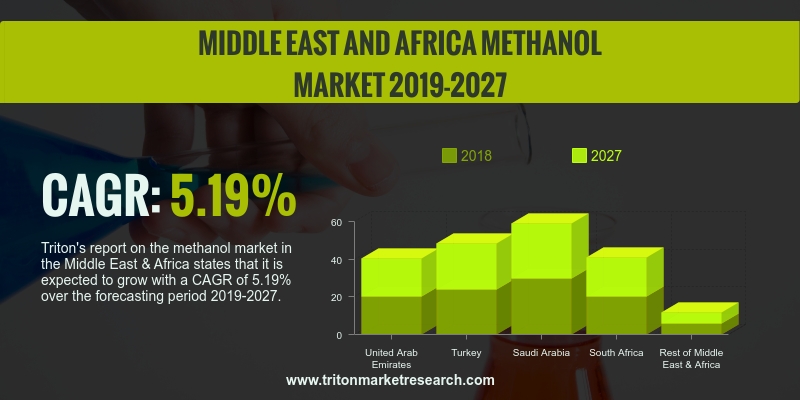

Triton's report on the methanol market in the Middle East & Africa states that it is expected to grow with a CAGR of 5.19% over the forecasting period 2019-2027.

The Middle East & Africa methanol market report scrutinizes the countries such as:

• Saudi Arabia

• The United Arab Emirates

• Turkey

• South Africa

• Rest of MEA

Report scope can be customized per your requirements. Request For Customization

The Middle East has large methanol sources in the form of natural, refinery and associated gas. The domestic demand for methanol in the Middle East is low, and hence the majority of methanol produced is exported to other regions such as Europe, North America and APAC. The domestic use and consumption of energy in the Middle East region are growing at a rapid rate. Over the past five years, the consumption of oil and gas in the UAE has increased. The Middle Eastern countries along with the UAE are considered to be the world’s leading producers of fossil fuels; however, owing to the launch of certain initiatives and policies regarding the use of clean technology, there is an increase in the use of renewable sources of energy.

Turkey’s automotive, construction and electronics industries are experiencing considerable growth. This will help in giving a required push to the methanol market in the country. Turkey’s contribution to the methanol market in 2018 was over 24%. Also, the methanol demand is expected to improve in African countries. Due to growth in the automotive and pharmaceutical industries, it is evident that the methanol market will also show promising growth. In rest of the Middle East & Africa, countries like Iran are experiencing an increase in the demand for methanol. This is because of clean technology being incorporated in these countries so as to develop a sustainable system.

The noteworthy companies in the methanol market are Methanol Holdings (Trinidad) Limited (MHTL), Celanese Corporation, Valero Marketing and Supply Company, Qatar Fuel Additives Company Limited, Methanex Corporation, Zagros Petrochemical Company (ZPC), Mitsui & Co., Ltd., Mitsubishi Chemicals, Saudi Basic Industries Corporation, Petroliam Nasional Berhad (PETRONAS), BASF AG and Teijin.

1.

MIDDLE EAST

AND AFRICA METHANOL MARKET - SUMMARY

2.

INDUSTRY

OUTLOOK

2.1. MARKET DEFINITION

2.2. KEY INSIGHTS

2.2.1. AUTOMOTIVE SECTOR HOLDS THE LARGEST MARKET SHARE

2.2.2. FORMALDEHYDE IS WIDELY USED DERIVATIVE OF METHANOL

2.3. PORTER’S FIVE FORCE ANALYSIS

2.3.1. THREAT OF NEW ENTRANTS

2.3.2. THREAT OF SUBSTITUTE

2.3.3. BARGAINING POWER OF SUPPLIERS

2.3.4. BARGAINING POWER OF BUYERS

2.3.5. INTENSITY OF COMPETITIVE RIVALRY

2.4. MARKET ATTRACTIVENESS INDEX

2.5. VENDOR SCORECARD

2.6. MARKET DRIVERS

2.6.1. RISING ACCEPTANCE OF THE MTO TECHNOLOGY

2.6.2. RISE IN THE DEMAND FOR PETROCHEMICALS

2.6.3. NEED FOR CONVENTIONAL TRANSPORTATION FUELS

2.6.4. PROMOTION OF METHANOL AS AN ALTERNATIVE FUEL BY THE GOVERNMENT

2.7. MARKET RESTRAINTS

2.7.1. SCARCITY OF RAW MATERIALS

2.7.2. USE OF FUEL GRADE ETHANOL OR BIOETHANOL INSTEAD OF METHANOL

2.8. MARKET OPPORTUNITIES

2.8.1. INCREASE IN THE DEMAND FOR BIO-BASED PRODUCTS

2.8.2. DEVELOPMENT IN TECHNOLOGY FOR BIOREFINING

2.8.3. APPLICATION OF METHANOL AS A MARINE FUEL

2.9. MARKET CHALLENGES

2.9.1. UNSTABLE METHANOL PRICES

2.9.2. ECONOMIC SLOWDOWN HINDERS THE

DEMAND FOR METHANOL

2.9.3. REGULATIONS AND POLICIES

3.

METHANOL MARKET

OUTLOOK - BY END-USER

3.1. AUTOMOTIVE

3.2. CONSTRUCTION

3.3. ELECTRONICS

3.4. PAINTS AND COATINGS

3.5. OTHER END-USERS

4.

METHANOL MARKET

OUTLOOK - BY DERIVATIVES

4.1. FORMALDEHYDE

4.2. ACETIC ACID

4.3. GASOLINE

4.4. DME

4.5. MTBE & TAME

4.6. OTHER DERIVATIVES

5.

METHANOL MARKET

- MIDDLE EAST AND AFRICA

5.1. UNITED ARAB EMIRATES

5.2. TURKEY

5.3. SAUDI ARABIA

5.4. SOUTH AFRICA

5.5. REST OF MIDDLE EAST AND AFRICA

6.

COMPETITIVE

LANDSCAPE

6.1. BASF AG

6.2. CELANESE CORPORATION

6.3. QATAR FUEL ADDITIVES COMPANY LIMITED

6.4. METHANOL HOLDINGS (TRINIDAD) LIMITED (MHTL)

6.5. METHANEX CORPORATION

6.6. MITSUBISHI CHEMICALS

6.7. MITSUI & CO., LTD.

6.8. PETROLIAM NASIONAL BERHAD (PETRONAS)

6.9. SAUDI BASIC INDUSTRIES CORPORATION

6.10.

TEIJIN

6.11.

VALERO

MARKETING AND SUPPLY COMPANY

6.12.

ZAGROS

PETROCHEMICAL COMPANY (ZPC)

7.

METHODOLOGY

& SCOPE

7.1. RESEARCH SCOPE

7.2. SOURCES OF DATA

7.3. RESEARCH METHODOLOGY

TABLE 1: MIDDLE EAST AND

AFRICA METHANOL MARKET, BY GEOGRAPHY, 2019-2027 (IN $ MILLION)

TABLE 2: MARKET ATTRACTIVENESS

INDEX

TABLE 3: VENDOR SCORECARD

TABLE 4: MIDDLE EAST AND

AFRICA METHANOL MARKET, BY COUNTRY, 2019-2027 (IN $ MILLION)

TABLE 5: MIDDLE EAST AND

AFRICA METHANOL MARKET, BY END-USERS, 2019-2027 (IN $ MILLION)

TABLE 6: MIDDLE EAST AND

AFRICA METHANOL MARKET, BY DERIVATIVES, 2019-2027 (IN $ MILLION)

FIGURE 1: MIDDLE EAST AND

AFRICA METHANOL MARKET, BY END-USER, 2018 & 2027 (IN %)

FIGURE 2: MIDDLE EAST AND

AFRICA AUTOMOTIVE MARKET FOR METHANOL, 2019-2027 (IN $ MILLION)

FIGURE 3: MIDDLE EAST AND

AFRICA FORMALDEHYDE MARKET, 2019-2027 (IN $ MILLION)

FIGURE 4: PORTER’S FIVE FORCE

ANALYSIS

FIGURE 5: MIDDLE EAST AND

AFRICA METHANOL MARKET, BY AUTOMOTIVE, 2019-2027 (IN $ MILLION)

FIGURE 6: MIDDLE EAST AND

AFRICA METHANOL MARKET, BY CONSTRUCTION, 2019-2027 (IN $ MILLION)

FIGURE 7: MIDDLE EAST AND

AFRICA METHANOL MARKET, BY ELECTRONICS, 2019-2027 (IN $ MILLION)

FIGURE 8: MIDDLE EAST AND

AFRICA METHANOL MARKET, BY PAINTS AND COATINGS, 2019-2027 (IN $ MILLION)

FIGURE 9: MIDDLE EAST AND

AFRICA METHANOL MARKET, BY OTHER END-USERS, 2019-2027 (IN $ MILLION)

FIGURE 10: MIDDLE EAST AND

AFRICA METHANOL MARKET, BY FORMALDEHYDE, 2019-2027 (IN $ MILLION)

FIGURE 11: MIDDLE EAST AND

AFRICA METHANOL MARKET, BY ACETIC ACID, 2019-2027 (IN $ MILLION)

FIGURE 12: MIDDLE EAST AND

AFRICA METHANOL MARKET, BY GASOLINE, 2019-2027 (IN $ MILLION)

FIGURE 13: MIDDLE EAST AND

AFRICA METHANOL MARKET, BY DME, 2019-2027 (IN $ MILLION)

FIGURE 14: MIDDLE EAST AND

AFRICA METHANOL MARKET, BY MTBE & TAME, 2019-2027 (IN $ MILLION)

FIGURE 15: MIDDLE EAST AND

AFRICA METHANOL MARKET, BY OTHER DERIVATIVES, 2019-2027 (IN $ MILLION)

FIGURE 16: MIDDLE EAST AND

AFRICA METHANOL MARKET, REGIONAL OUTLOOK, 2018 & 2027 (IN %)

FIGURE 37: UNITED ARAB

EMIRATES METHANOL MARKET, 2019-2027 (IN $ MILLION)

FIGURE 38: TURKEY METHANOL

MARKET, 2019-2027 (IN $ MILLION)

FIGURE 39: SAUDI ARABIA

METHANOL MARKET, 2019-2027 (IN $ MILLION)

FIGURE 40: SOUTH AFRICA

METHANOL MARKET, 2019-2027 (IN $ MILLION)

FIGURE 41: REST OF

MIDDLE EAST AND AFRICA METHANOL MARKET, 2019-2027 (IN $ MILLION)