Market By Type, End-users, Technology And Geography | Forecast 2019-2027

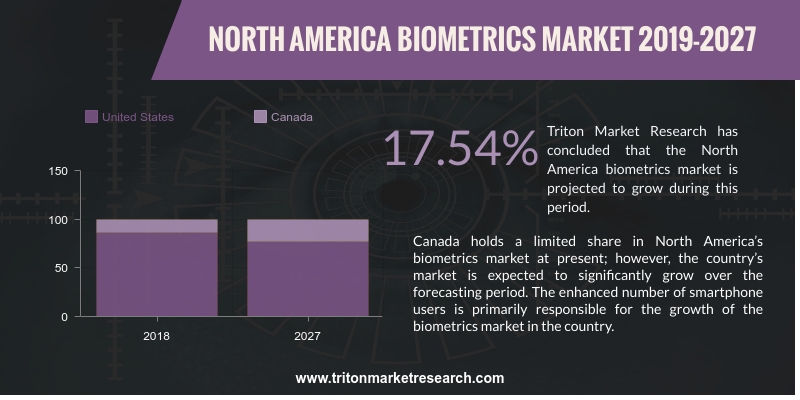

Triton Market Research has concluded that the North America biometrics market is projected to grow at a CAGR of 17.54% in the estimated years 2019-2027.

The countries included in North America’s biometrics market are:

• The United States

• Canada

Canada holds a limited share in North America’s biometrics market at present; however, the country’s market is expected to significantly grow over the forecasting period. The enhanced number of smartphone users is primarily responsible for the growth of the biometrics market in the country. The proliferation of smartphones in the country can be mainly attributed to the frequency in the number of new applications being developed.

Canada is one of the leading countries considering the penetration of smartphones, with over 75% of the population using these devices, as stated by the Canadian Radio-Television and Telecommunications Commission. This calls for the security of a large proportion of data on the device as well as on the cloud. The biometric technology thus plays a critical role owing to its applications such as authentication and identification services.

Several market giants such as S.I.C. Biometrics and Applied Recognition, Inc. have launched biometric devices in Canada’s biometrics market. A news article released in January 2015 states that a new device called ‘on-the-job tracking system’ was stationed at airports in Halifax, Toronto and Montreal, which requires handlers to scan their fingerprints for clocking-in and out of work.

Crossmatch Technologies, Inc. is a biometric company offering biometric identity management solutions. Its products include mobile biometric devices, multimodal jump kits, multimodal field solutions, document readers, child ID solutions, livescan systems, fingerprint & palm scanners, single-dual finger scanners, facial capture software, iris capture devices and enterprise & application software, among others. Crossmatch offers professional services, design & installation, implementation & optimization, program management, consulting, system integration & assessment, strategic planning and training services. The company serves financial institutions, governments, retail organizations, defense departments, law enforcement agencies, government & commercial organizations and private enterprises. Crossmatch has operations in Florida, California and Virginia, the US. It is headquartered in Palm Beach Gardens, the United States.

1.

NORTH AMERICA BIOMETRICS MARKET - SUMMARY

2.

INDUSTRY OUTLOOK

2.1. MARKET DEFINITION

2.2. COMPONENTS OF A BIOMETRIC ACCESS CONTROL SYSTEM

2.2.1.

INPUT EXTRACTION

2.2.2.

TRANSMISSION & SIGNAL PROCESSING

2.2.3.

QUALITY ASSESSMENT

2.2.4.

DATA STORAGE

2.3. KEY INSIGHTS

2.3.1.

FAVORABLE GOVERNMENT INITIATIVES

2.3.2.

INTRODUCTION OF MULTIMODAL BIOMETRIC TECHNOLOGY

2.3.3.

RAPID ADOPTION BY BANKING & FINANCIAL SERVICE INDUSTRIES

2.4. PORTER’S FIVE FORCE ANALYSIS

2.4.1.

BARGAINING POWER OF BUYERS

2.4.2.

BARGAINING POWER OF SUPPLIERS

2.4.3.

THREAT OF NEW ENTRANTS

2.4.4.

THREAT OF SUBSTITUTE

2.4.5.

THREAT OF COMPETITIVE RIVALRY

2.5. MARKET ATTRACTIVENESS INDEX

2.6. VENDOR SCORECARD

2.7. INDUSTRY COMPONENTS

2.7.1.

CORE TECHNOLOGY

2.7.2.

PHYSICAL COMPONENTS MANUFACTURER

2.7.3.

INTEGRATED BIOMETRIC DEVICES

2.7.4.

MARKETING AND DISTRIBUTION

2.7.5.

END-USERS

2.8. MARKET DRIVERS

2.8.1.

INCREASED SAFETY & SECURITY CONCERNS

2.8.2.

RISE IN IDENTITY THREATS & RELATED COSTS

2.8.3.

IMMENSE PROLIFERATION OF SMARTPHONES & TABLETS WITH BIOMETRIC

CAPABILITIES

2.9. MARKET RESTRAINTS

2.9.1.

HIGH COST OF TECHNOLOGY

2.9.2.

DIFFICULTIES IN INTEGRATING BIOMETRICS INTO EXISTING SOFTWARE

2.10. MARKET OPPORTUNITIES

2.10.1.

THRIVING E-COMMERCE INDUSTRY

2.10.2.

EMERGENCE OF E-PASSPORT

2.11. MARKET CHALLENGES

2.11.1.

TECHNICAL LIMITATIONS ASSOCIATED WITH BIOMETRIC TECHNOLOGY

2.11.2.

DATA SECURITY & PRIVACY ISSUES

3.

NORTH AMERICA BIOMETRICS MARKET OUTLOOK – BY TYPE

3.1. FIXED

3.2. MOBILE

4.

NORTH AMERICA BIOMETRICS MARKET OUTLOOK – BY END-USERS

4.1. GOVERNMENT

4.2. TRANSPORTATION

4.3. BFSI

4.4. HEALTHCARE

4.5. IT & TELECOMMUNICATION

4.6. RETAIL

4.7. OTHER END-USERS

5.

NORTH AMERICA BIOMETRICS MARKET OUTLOOK – BY TECHNOLOGY

5.1. FINGERPRINT RECOGNITION

5.2. IRIS RECOGNITION

5.3. FACIAL RECOGNITION

5.4. HAND GEOMETRY

5.5. VEIN ANALYSIS

5.6. VOICE RECOGNITION

5.7. DNA ANALYSIS

5.8. GAIT

5.9. EEG/ECG

5.10. OTHER TECHNOLOGIES

6.

NORTH AMERICA BIOMETRICS MARKET – REGIONAL OUTLOOK

6.1. UNITED STATES

6.2. CANADA

7.

COMPETITIVE LANDSCAPE

7.1. AWARE, INC.

7.2. BIO-KEY INTERNATIONAL, INC.

7.3. CROSSMATCH TECHNOLOGIES, INC. (ACQUIRED BY

HID NORTH AMERICA)

7.4. FINGERPRINT CARDS AB

7.5. FUJITSU LIMITED

7.6. FULCRUM BIOMETRICS LLC

7.7. GEMALTO N.V.

7.8. HID GLOBAL CORPORATION

7.9. IMAGEWARE SYSTEMS

7.10. IRIS ID SYSTEMS, INC.

7.11. M2SYS TECHNOLOGIES, INC.

7.12. NEC CORPORATION

7.13. NUANCE COMMUNICATIONS, INC.

7.14. IDEMIA FRANCE S.A.S. (SAFRAN IDENTITY &

SECURITY S.A.S.)

7.15. PRECISE BIOMETRICS AB

7.16. SIEMENS AG

8.

RESEARCH METHODOLOGY & SCOPE

8.1. RESEARCH SCOPE & DELIVERABLES

8.2. SOURCES OF DATA

8.3. RESEARCH METHODOLOGY

TABLE 1: NORTH AMERICA BIOMETRICS MARKET, BY COUNTRY, 2019-2027 (IN $

MILLION)

TABLE 2: GOVERNMENT INITIATIVES & POLICIES RELATED TO BIOMETRICS

TABLE 3: VENDOR SCORECARD

TABLE 4: INSTANCES OF IDENTITY THEFTS IN KEY GEOGRAPHIES, 2017

TABLE 5: SOME OF THE PROMISING E-PASSPORT PROJECTS

TABLE 6: NORTH AMERICA BIOMETRICS MARKET, BY TYPE, 2019-2027 (IN $

MILLION)

TABLE 7: NORTH AMERICA BIOMETRICS MARKET, BY END-USERS, 2019-2027 (IN $

MILLION)

TABLE 8: NORTH AMERICA BIOMETRICS MARKET, BY TECHNOLOGY, 2019-2027 (IN $

MILLION)

TABLE 9: NORTH AMERICA BIOMETRICS MARKET, BY COUNTRY, 2019-2027 (IN $

MILLION)

FIGURE 1: BASIC COMPONENTS OF BIOMETRIC AUTHENTICATION SYSTEMS

FIGURE 2: MARKET ATTRACTIVENESS INDEX

FIGURE 3: INDUSTRY COMPONENTS

FIGURE 4: INTERNAL PROCESS FOR IDENTIFICATION BY BIOMETRIC TECHNOLOGY

FIGURE 5: AVERAGE CYBERCRIME COST IN KEY GEOGRAPHIES, AUGUST 2017 (IN $

MILLION)

FIGURE 6: NORTH AMERICA BIOMETRICS MARKET, BY FIXED, 2019-2027 (IN $

MILLION)

FIGURE 7: NORTH AMERICA BIOMETRICS MARKET, BY MOBILE, 2019-2027 (IN $

MILLION)

FIGURE 8: NORTH AMERICA BIOMETRICS MARKET, BY GOVERNMENT, 2019-2027 (IN

$ MILLION)

FIGURE 9: NORTH AMERICA BIOMETRICS MARKET, BY TRANSPORTATION, 2019-2027

(IN $ MILLION)

FIGURE 10: NORTH AMERICA BIOMETRICS MARKET, BY BFSI, 2019-2027 (IN $

MILLION)

FIGURE 11: NORTH AMERICA BIOMETRICS MARKET, BY HEALTHCARE, 2019-2027 (IN

$ MILLION)

FIGURE 12: NORTH AMERICA BIOMETRICS MARKET, BY IT &

TELECOMMUNICATION, 2019-2027 (IN $ MILLION)

FIGURE 13: NORTH AMERICA BIOMETRICS MARKET, BY RETAIL, 2019-2027 (IN $

MILLION)

FIGURE 14: NORTH AMERICA BIOMETRICS MARKET, BY OTHER END-USERS,

2019-2027 (IN $ MILLION)

FIGURE 15: NORTH AMERICA BIOMETRICS MARKET, BY FINGERPRINT RECOGNITION,

2019-2027 (IN $ MILLION)

FIGURE 16: NORTH AMERICA BIOMETRICS MARKET, BY IRIS RECOGNITION,

2019-2027 (IN $ MILLION)

FIGURE 17: NORTH AMERICA BIOMETRICS MARKET, BY FACIAL RECOGNITION,

2019-2027 (IN $ MILLION)

FIGURE 18: NORTH AMERICA BIOMETRICS MARKET, BY HAND GEOMETRY, 2019-2027

(IN $ MILLION)

FIGURE 19: NORTH AMERICA BIOMETRICS MARKET, BY VEIN ANALYSIS, 2019-2027

(IN $ MILLION)

FIGURE 20: NORTH AMERICA BIOMETRICS MARKET, BY VOICE RECOGNITION,

2019-2027 (IN $ MILLION)

FIGURE 21: NORTH AMERICA BIOMETRICS MARKET, BY DNA ANALYSIS, 2019-2027

(IN $ MILLION)

FIGURE 22: NORTH AMERICA BIOMETRICS MARKET, BY GAIT, 2019-2027 (IN $

MILLION)

FIGURE 23: NORTH AMERICA BIOMETRICS MARKET, BY EEG/ECG, 2019-2027 (IN $

MILLION)

FIGURE 24: NORTH AMERICA BIOMETRICS MARKET, BY OTHER TECHNOLOGIES,

2019-2027 (IN $ MILLION)

FIGURE 25: UNITED STATES BIOMETRICS MARKET, 2019-2027 (IN $ MILLION)

FIGURE 26: CANADA BIOMETRICS MARKET, 2019-2027 (IN $ MILLION)