Market By Application, Type And Geography | Forecast 2019-2027

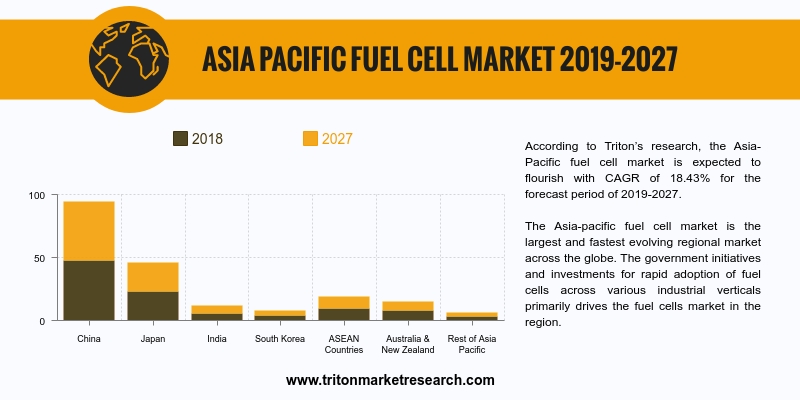

According to Triton’s research, the Asia- Pacific fuel cell market is expected to flourish with CAGR of 18.43% for the forecast period of 2019-2027.

The Asia-Pacific fuel cell market includes countries such as:

• China

• India

• Japan

• South Korea

• ASEAN countries

• Australia & New Zealand

• Rest of Asia-Pacific

We provide additional customization based on your specific requirements. Request For Customization

The Asia-pacific fuel cell market is the largest and fastest evolving regional market across the globe. The government initiatives and investments for rapid adoption of fuel cells across various industrial verticals primarily drives the fuel cells market in the region. The government imposed stringent environmental regulations on companies that abide them to adopt for cleaner technology like fuel cells. Also, the rising adoption of fuel cells electric vehicles, hybrid electric vehicles, Combined Heat & Power (CHP), fuel cells in power generation plants and others drive the demand for fuel cells, thereby escalating the market growth.

Japan is the dominant market in the Asia-Pacific fuel cells market, owing to its significant demand of Combined Heat & Power (CHP) systems and various government initiatives for adoption of renewable fuelling stations. On the other hand, China’s fuel cells market is driven mainly by the public-private partnerships along with government policies and incentives supporting fuel cell electric vehicles. The expanding fuel cells market in India attributes to the favourable government policies supporting renewable energy technologies and providing generation-based incentives, capital and interest subsidies. While South Korea evolved as a world leader in fuel cell power production and installed the largest fuel cell park, Australia is investing in Next-generation hydrogen-fuelled vehicles, thus escalating the region’s fuel cell market.

1. ASIA

PACIFIC FUEL CELL MARKET- SUMMARY

2. INDUSTRY

OUTLOOK

2.1. MARKET

DEFINITION

2.2. KEY

INSIGHTS

2.2.1. PROMISING

INVESTMENTS IN FUEL CELL

2.2.2. INCREASING

NUMBER OF PARTNERSHIPS BETWEEN PUBLIC & PRIVATE COMPANIES

2.2.3. GROWING

APPLICATION OF FUEL CELL IN EV’S, HEV’S & PHEV’S

2.2.4. PROACTIVE

INVOLVEMENT OF UNIVERSITIES, GOVERNMENT ORGANIZATIONS & COMPANIES IN

R&D

2.3. PORTER’S

FIVE FORCE ANALYSIS

2.3.1. THREAT

OF NEW ENTRANTS

2.3.2. THREAT

OF SUBSTITUTE

2.3.3. BARGAINING

POWER OF SUPPLIERS

2.3.4. BARGAINING

POWER OF BUYERS

2.3.5. THREAT

OF COMPETITIVE RIVALRY

2.4. MARKET

ATTRACTIVENESS INDEX

2.5. VENDOR

SCORECARD

2.6. INDUSTRY

COMPONENTS

2.6.1. RAW

MATERIAL SUPPLIERS

2.6.2. MANUFACTURERS

2.6.3. DISTRIBUTORS

2.6.4. END-USERS

2.7. KEY

IMPACT ANALYSIS

2.7.1. COST

2.7.2. APPLICATION

2.7.3. EFFICIENCY

2.8. REGULATORY

FRAMEWORK

2.9. INDUSTRY

PLAYER POSITIONING

2.10.

MARKET DRIVERS

2.10.1. BENEFITS

OFFERED BY FUEL CELLS OVER OTHER POWER GENERATING SYSTEMS

2.10.2. GROWING

DEMAND FOR EFFICIENT & CLEANER TECHNOLOGIES

2.10.3. RAPID

INTEGRATION OF FUEL CELL TECHNOLOGY IN AUTOMOBILES

2.11.

MARKET RESTRAINTS

2.11.1. ISSUES

WITH DURABILITY OF FUEL CELL TECHNOLOGY

2.11.2. HIGH

CAPITAL COST OF FUEL CELLS

2.12.

MARKET OPPORTUNITIES

2.12.1. DECLINING

PRICES OF FUEL CELLS & FCV’S

2.12.2. GROWING

NUMBER OF HYDROGEN REFUELLING STATIONS

2.13.

MARKET CHALLENGES

2.13.1. AVAILABILITY

OF ALTERNATIVE TECHNOLOGIES

2.13.2. LACK

OF FUEL INFRASTRUCTURE

3. ASIA

PACIFIC FUEL CELL INDUSTRY OUTLOOK - BY APPLICATION

3.1. TRANSPORTATION

3.2. STATIONARY

3.3. PORTABLE

4. ASIA

PACIFIC FUEL CELL INDUSTRY OUTLOOK - BY TYPE

4.1. SOLID

OXIDE FUEL CELLS (SOFC)

4.2. PHOSPHORIC

ACID FUEL CELLS (PAFC)

4.3. MOLTEN

CARBONATE FUEL CELLS (MCFC)

4.4. PROTON EXCHANGE MEMBRANE FUEL CELLS

(PEMFC)

4.5. OTHER

FUEL CELLS

5. ASIA

PACIFIC FUEL CELL INDUSTRY – REGIONAL OUTLOOK

5.1. CHINA

5.2. JAPAN

5.3. INDIA

5.4. SOUTH

KOREA

5.5. ASEAN

COUNTRIES

5.6. AUSTRALIA

& NEW ZEALAND

5.7. REST

OF ASIA PACIFIC

6. COMPETITIVE

LANDSCAPE

6.1. HITACHI

LTD

6.2. GENERAL

ELECTRIC COMPANY

6.3. EXXON

MOBIL CORPORATION

6.4. AFC

ENERGY PLC

6.5. FUELCELL

ENERGY INC

6.6. HYDROGENICS

CORPORATION

6.7. AISIN

SEIKI CO LTD

6.8. BALLARD

POWER SYSTEMS

6.9. BLOOM

ENERGY CORPORATION

6.10.

CERES POWER HOLDINGS PLC

6.11.

PLUG POWER INC

6.12.

SFC ENERGY

AG

6.13.

PANASONIC CORPORATION

6.14.

TOYOTA MOTOR CORPORATION

6.15.

TOSHIBA CORPORATION

7. RESEARCH

METHODOLOGY & SCOPE

7.1. RESEARCH

SCOPE & DELIVERABLES

7.2. SOURCES

OF DATA

7.3. RESEARCH

METHODOLOGY

TABLE 1: ASIA PACIFIC FUEL

CELL MARKET, BY COUNTRY, 2019-2027 (IN $ MILLION)

TABLE 2: PROMINENT INVESTMENT

IN FUEL CELLS

TABLE 3: VENDOR SCORECARD

TABLE 4: REGULATORY FRAMEWORK

TABLE 5: TYPICAL STACK SIZE OF

DIFFERENT FUEL CELL TECHNOLOGIES

TABLE 6: ENERGY CONVERSION

EFFICIENCY OF DIFFERENT ENERGY SOURCES

TABLE 7: ESTIMATED NUMBER OF

FCEV’S ON ROAD IN KEY GEOGRAPHIES, 2014- 2020

TABLE 8: ASIA PACIFIC FUEL

CELL MARKET, BY COUNTRY, 2019-2027 (IN $ MILLION)

TABLE 9: ASIA PACIFIC FUEL

CELL MARKET, BY APPLICATION, 2019-2027 (IN $ MILLION)

TABLE 10: ASIA PACIFIC FUEL

CELL MARKET, BY TYPE, 2019-2027 (IN $ MILLION)

FIGURE 1: ASIA PACIFIC FUEL

CELL MARKET, BY APPLICATION, 2018 & 2027 (IN %)

FIGURE 2: NETL’S SOFC PROGRAM

FIGURE 3: MARKET

ATTRACTIVENESS INDEX

FIGURE 4: INDUSTRY COMPONENTS

FIGURE 5: KEY IMPACT ANALYSIS

FIGURE 6: INDUSTRY PLAYER POSITIONING

IN 2018 (IN %)

FIGURE 7: FUEL CELL SYSTEM

COSTS ($)

FIGURE 8: ESTIMATED NUMBER OF

HYDROGEN FUELING STATIONS IN KEY GEOGRAPHIES, 2014-2020

FIGURE 9: ASIA PACIFIC FUEL

CELL MARKET, BY TRANSPORTATION, 2019-2027 (IN $ MILLION)

FIGURE 10: ASIA PACIFIC FUEL

CELL MARKET, BY STATIONARY, 2019-2027 (IN $ MILLION)

FIGURE 11: ASIA PACIFIC FUEL

CELL MARKET, BY PORTABLE, 2019-2027 (IN $ MILLION)

FIGURE 12: ASIA PACIFIC FUEL

CELL MARKET, BY SOLID OXIDE FUEL CELLS (SOFC), 2019-2027 (IN $ MILLION)

FIGURE 13: ASIA PACIFIC FUEL

CELL MARKET, BY PHOSPHORIC ACID FUEL CELLS (PAFC), 2019-2027 (IN $ MILLION)

FIGURE 14: ASIA PACIFIC FUEL

CELL MARKET, BY MOLTEN CARBONATE FUEL CELLS (MCFC), 2019-2027 (IN $ MILLION)

FIGURE 15: ASIA PACIFIC FUEL

CELL MARKET, BY PROTON EXCHANGE MEMBRANE FUEL

CELLS (PEMFC), 2019-2027 (IN $ MILLION)

FIGURE 16: ASIA PACIFIC FUEL

CELL MARKET, BY OTHER FUEL CELLS, 2019-2027 (IN $ MILLION)

FIGURE 17: ASIA PACIFIC FUEL

CELL MARKET, REGIONAL OUTLOOK, 2018 & 2027 (IN %)

FIGURE 18: CHINA FUEL CELL

MARKET, 2019-2027 (IN $ MILLION)

FIGURE 19: JAPAN FUEL CELL

MARKET, 2019-2027 (IN $ MILLION)

FIGURE 20: INDIA FUEL CELL

MARKET, 2019-2027 (IN $ MILLION)

FIGURE 21: SOUTH KOREA FUEL

CELL MARKET, 2019-2027 (IN $ MILLION)

FIGURE 22: ASEAN COUNTRIES

FUEL CELL MARKET, 2019-2027 (IN $ MILLION)

FIGURE 23: AUSTRALIA & NEW

ZEALAND FUEL CELL MARKET, 2019-2027 (IN $ MILLION)

FIGURE 24: REST OF ASIA

PACIFIC FUEL CELL MARKET, 2019-2027 (IN $ MILLION)