Market By Type, Substrate Material, End Users And Geography | Forecasts 2019-2027

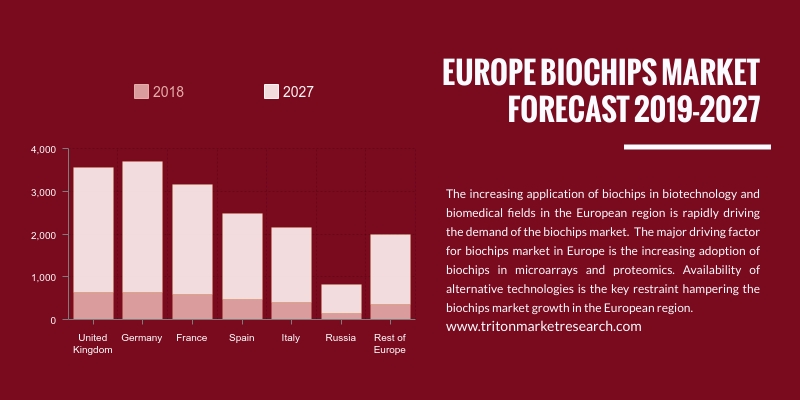

The Europe biochips market is expected to display an upward trend and is estimated to grow at a CAGR of 18.91% during the forecasted years of 2019 to 2027.

The countries covered in the Europe biochips market are:

o United Kingdom

o Germany

o France

o Italy

o Spain

o Russia

o Rest of Europe

We provide additional customization based on your specific requirements. Request For Customization

Biochips finds its uses in areas like genomics (for cancer diagnosis and treatment), drug discovery, gene expression, point of care & In Vitro diagnosis and proteomics. Germany & the UK are the most significant economies in the European region for biochips market. Germany holds the largest share in the European biochips market. The biochips market is studied based on various segments, which include type, substrate material, and end users.

The report of the biochips market by Triton provides the market insights of DNA chips, protein chips, and lab on chip substrate materials. The report also provides details about Porter’s five force analysis, market definition, market attractiveness index, vendor scorecard, regulatory framework, forecast, and market sizing of biochips market in the European region, followed by the market drivers, restraints, opportunities and challenges.

The increasing application of biochips in biotechnology and biomedical fields is rapidly driving the demand of the biochips market in the European region. The major driving factor for biochips market in Europe is the increasing adoption of biochips in microarrays and proteomics. The availability of alternative technologies is the key restraint hampering the biochips market growth in the region.

1. BIOCHIPS

MARKET - SUMMARY

2. INDUSTRY

OUTLOOK

2.1. MARKET

DEFINITION

2.2. KEY

INSIGHTS

2.3. EVOLUTION

& TRANSITION OF BIOCHIPS

2.4. PORTER'S

FIVE FORCE ANALYSIS

2.5. MARKET

ATTRACTIVENESS MATRIX

2.6. INDUSTRY

COMPONENTS

2.7. REGULATORY

FRAMEWORK

2.8. VENDOR

SCORECARD

2.9. KEY

IMPACT ANALYSIS

2.10.

MARKET OPPORTUNITY INSIGHTS

2.11.

INDUSTRY PLAYER POSITIONING

2.12.

KEY MARKET STRATEGIES

2.13.

MARKET DRIVERS

2.13.1.

GROWTH IN PERSONALIZED

MEDICINES

2.13.2.

RISING INCIDENCES &

TREATMENT OF CANCER

2.13.3.

CONSTANT RISE IN HEALTHCARE

SPENDING WORLDWIDE

2.13.4.

INCREASING NUMBER OF

INVESTMENTS IN BIOTECHNOLOGY R&D

2.14.

MARKET RESTRAINTS

2.14.1.

INEQUALITY IN HEALTHCARE

ACCESS

2.14.2.

INADEQUATE TECHNICAL AWARENESS

RELATED TO BIOCHIPS

2.14.3.

COMPLEXITY OF BIOLOGICAL

SYSTEMS

2.15.

MARKET OPPORTUNITIES

2.15.1.

DEVELOPMENTS IN BIOCHIPS

TECHNOLOGY

2.15.2.

WIDENING APPLICATION AREAS OF

BIOCHIPS

2.16.

MARKET CHALLENGES

2.16.1.

AVAILABILITY OF SUBSTITUTE

TECHNOLOGIES

2.16.2.

UNCLEAR REGULATORY GUIDELINES

2.16.3.

COST CONSTRAINTS

3. BIOCHIPS

INDUSTRY OUTLOOK – BY TYPE

3.1. DNA

CHIPS

3.1.1. AGRICULTURAL

BIOTECHNOLOGY

3.1.2. CANCER

DIAGNOSTICS & TREATMENT

3.1.3. DRUG

DISCOVERY

3.1.4. GENE

EXPRESSION

3.1.5. GENOMICS

3.1.6. SINGLE

NUCLEOTIDE POLYMORPHISM (SNP) GENOTYPING

3.1.7. OTHER

DNA CHIPS

3.2. LAB

ON A CHIP

3.2.1. CLINICAL

DIAGNOSTICS

3.2.2. DRUG

DISCOVERY

3.2.3. GENOMICS

3.2.4. POINT

OF CARE & IN VITRO DIAGNOSIS

3.2.5. PROTEOMICS

3.2.6. OTHER

LAB ON A CHIP

3.3. PROTEIN

CHIPS

3.3.1. DIAGNOSTICS

3.3.2. DRUG

DISCOVERY

3.3.3. EXPRESSION

PROFILING

3.3.4. HIGH

THROUGHPUT SCREENING

3.3.5. PROTEOMICS

3.3.6. OTHER

PROTEIN CHIPS

3.4. OTHER

CHIPS

3.4.1. CELL

ARRAYS

3.4.2. TISSUE

ARRAYS

4. BIOCHIPS

INDUSTRY OUTLOOK - BY SUBSTRATE MATERIAL

4.1. GLASS

4.2. POLYMERS

4.3. SILICON

4.4. OTHER

SUBSTRATE MATERIALS

5. BIOCHIPS

INDUSTRY OUTLOOK - BY END USER

5.1. BIOTECHNOLOGY

AND PHARMACEUTICAL COMPANIES

5.2. HOSPITALS

AND DIAGNOSTICS CENTERS

5.3. ACADEMIC

AND RESEARCH INSTITUTE

6. BIOCHIPS

INDUSTRY - EUROPE

6.1. UNITED

KINGDOM

6.2. GERMANY

6.3. FRANCE

6.4. ITALY

6.5. SPAIN

6.6. RUSSIA

6.7. REST

OF EUROPE

7. COMPETITIVE

LANDSCAPE

7.1. AGILENT

TECHNOLOGY INC.

7.2. BIOCHAIN

INSTITUTE INC.

7.3. BIOMERIEUX

SA

7.4. BIO-RAD

LABORATORIES INC.

7.5. CEPHEID

INC.

7.6. CYBRDI

INC.

7.7. FLUIDIGM

CORPORATION

7.8. GAMIDA

FOR LIFE GROUP

7.9. ILLUMINA

INC.

7.10.

IMGENEX

7.11.

MERCK GMBH

7.12.

ORIGENE TECHNOLOGIES INC.

7.13.

PERKINELMER INC.

7.14.

SAMSUNG ELECTRONICS INC.

7.15.

THERMO FISHER SCIENTIFIC INC.

8. METHODOLOGY

& SCOPE

8.1. RESEARCH

SCOPE

8.2. SOURCES

OF DATA

8.3. RESEARCH METHODOLOGY

TABLE 1. MARKET

ATTRACTIVENESS MATRIX FOR BIOCHIPS MARKET

TABLE 2. VENDOR SCORECARD

OF BIOCHIPS MARKET

TABLE 3. REGULATORY

FRAMEWORK OF BIOCHIPS MARKET

TABLE 4. KEY STRATEGIC

DEVELOPMENTS IN BIOCHIPS MARKET

TABLE 5. NOTABLE

INVESTMENTS MADE IN BIOTECHNOLOGY INDUSTRY IN 2017

TABLE 6. EUROPE

BIOCHIPS MARKET, COUNTRY OUTLOOK, 2019-2027 (IN $ MILLION)

TABLE 7. EUROPE

BIOCHIPS MARKET, BY TYPE, 2019-2027 (IN $ MILLION)

TABLE 8. EUROPE

BIOCHIPS MARKET, BY SUBSTRATE MATERIAL, 2019-2027 (IN $ MILLION)

TABLE 9. EUROPE

BIOCHIPS MARKET, BY END USER, 2019-2027 (IN $ MILLION)

FIGURE 1. EUROPE

BIOCHIPS MARKET, 2019-2027 (IN $ MILLION)

FIGURE 2. PORTER’S FIVE

FORCE ANALYSIS OF BIOCHIPS MARKET

FIGURE 3. KEY IMPACT

ANALYSIS

FIGURE 4. TIMELINE OF

BIOCHIPS

FIGURE 5. MARKET

OPPORTUNITY INSIGHTS, BY TYPE, 2018

FIGURE 6. MARKET OPPORTUNITY

INSIGHTS, BY END USER, 2018

FIGURE 7. INDUSTRY

COMPONENTS OF BIOCHIPS MARKET

FIGURE 8. KEY PLAYER

POSITIONING IN 2018 (%)

FIGURE 9. COMPARISON OF

HEALTHCARE SPENDING PER CAPITA AND OUT OF THE POCKET HEALTH EXPENDITURE

FIGURE 10. EUROPE BIOCHIPS

MARKET, BY DNA CHIPS, 2019-2027 (IN $ MILLION)

FIGURE 11. EUROPE DNA

CHIPS MARKET, BY AGRICULTURAL BIOTECHNOLOGY, 2019-2027 (IN $ MILLION)

FIGURE 12. EUROPE DNA

CHIPS MARKET, BY CANCER DIAGNOSTICS & TREATMENT, 2019-2027 (IN $ MILLION)

FIGURE 13. EUROPE DNA

CHIPS MARKET, BY DRUG DISCOVERY, 2019-2027 (IN $ MILLION)

FIGURE 14. EUROPE DNA

CHIPS MARKET, BY GENE EXPRESSION, 2019-2027 (IN $ MILLION)

FIGURE 15. EUROPE DNA

CHIPS MARKET, BY GENOMICS, 2019-2027 (IN $ MILLION)

FIGURE 16. EUROPE DNA

CHIPS MARKET, BY SINGLE NUCLEOTIDE POLYMORPHISM (SNP) GENOTYPING, 2019-2027 (IN

$ MILLION)

FIGURE 17. EUROPE DNA

CHIPS MARKET, BY OTHER CHIPS, 2019-2027 (IN $ MILLION)

FIGURE 18. EUROPE

BIOCHIPS MARKET, BY LAB ON A CHIP, 2019-2027 (IN $ MILLION)

FIGURE 19. EUROPE LAB

ON A CHIP MARKET, BY CLINICAL DIAGNOSTICS, 2019-2027 (IN $ MILLION)

FIGURE 20. EUROPE LAB

ON A CHIP MARKET, BY DRUG DISCOVERY, 2019-2027 (IN $ MILLION)

FIGURE 21. EUROPE LAB

ON A CHIP MARKET, BY GENOMICS, 2019-2027 (IN $ MILLION)

FIGURE 22. EUROPE LAB ON

A CHIP MARKET, BY POINT OF CARE & IN VITRO DIAGNOSIS, 2019-2027 (IN $

MILLION)

FIGURE 23. EUROPE LAB

ON A CHIP MARKET, BY PROTEOMICS, 2019-2027 (IN $ MILLION)

FIGURE 24. EUROPE LAB

ON A CHIP MARKET, BY OTHER LAB ON A CHIP, 2019-2027 (IN $ MILLION)

FIGURE 25. EUROPE

BIOCHIPS MARKET, BY PROTEIN CHIPS, 2019-2027 (IN $ MILLION)

FIGURE 26. EUROPE

PROTEIN CHIPS MARKET, BY DIAGNOSTICS, 2019-2027 (IN $ MILLION)

FIGURE 27. EUROPE

PROTEIN CHIPS MARKET, BY DRUG DISCOVERY, 2019-2027 (IN $ MILLION)

FIGURE 28. EUROPE

PROTEIN CHIPS MARKET, BY EXPRESSION PROFILING, 2019-2027 (IN $ MILLION)

FIGURE 29. EUROPE

PROTEIN CHIPS MARKET, BY HIGH THROUGHPUT SCREENING, 2019-2027 (IN $ MILLION)

FIGURE 30. EUROPE

PROTEIN CHIPS MARKET, BY PROTEOMICS, 2019-2027 (IN $ MILLION)

FIGURE 31. EUROPE

PROTEIN CHIPS MARKET, BY OTHER PROTEIN CHIPS, 2019-2027 (IN $ MILLION)

FIGURE 32. EUROPE

BIOCHIPS MARKET, BY OTHER CHIPS, 2019-2027 (IN $ MILLION)

FIGURE 33. EUROPE OTHER

BIOCHIPS MARKET, BY CELL ARRAYS, 2019-2027 (IN $ MILLION)

FIGURE 34. EUROPE OTHER

BIOCHIPS MARKET, BY TISSUE ARRAYS, 2019-2027 (IN $ MILLION)

FIGURE 35. EUROPE

BIOCHIPS MARKET, BY GLASS, 2019-2027 (IN $ MILLIONS)

FIGURE 36. EUROPE

BIOCHIPS MARKET, BY POLYMERS, 2019-2027 (IN $ MILLIONS)

FIGURE 37. EUROPE

BIOCHIPS MARKET, BY SILICON, 2019-2027 (IN $ MILLIONS)

FIGURE 38. EUROPE

BIOCHIPS MARKET, BY OTHER SUBSTRATE MATERIALS, 2019-2027 (IN $ MILLIONS)

FIGURE 39. EUROPE

BIOCHIPS MARKET, BY BIOTECHNOLOGY AND PHARMACEUTICAL COMPANIES, 2019-2027 (IN $

MILLIONS)

FIGURE 40. EUROPE

BIOCHIPS MARKET, BY HOSPITALS AND DIAGNOSTICS CENTERS, 2019-2027 (IN $

MILLIONS)

FIGURE 41. EUROPE

BIOCHIPS MARKET, BY ACADEMIC AND RESEARCH INSTITUTE, 2019-2027 (IN $ MILLIONS)

FIGURE 42. EUROPE

BIOCHIPS MARKET, REGIONAL OUTLOOK, 2017 & 2026 (IN %)

FIGURE 43. UNITED

KINGDOM BIOCHIPS MARKET, 2019-2027 (IN $ MILLION)

FIGURE 44. GERMANY

BIOCHIPS MARKET, 2019-2027 (IN $ MILLION)

FIGURE 45. FRANCE

BIOCHIPS MARKET, 2019-2027 (IN $ MILLION)

FIGURE 46. ITALY

BIOCHIPS MARKET, 2019-2027 (IN $ MILLION)

FIGURE 47. SPAIN BIOCHIPS

MARKET, 2019-2027 (IN $ MILLION)

FIGURE 48. RUSSIA

BIOCHIPS MARKET, 2019-2027 (IN $ MILLION)

FIGURE 49. REST OF

EUROPE BIOCHIPS MARKET, (IN $ MILLION)