Market By Fuel Type, Power, Application, End-user, And Geography | Forecast 2019-2027

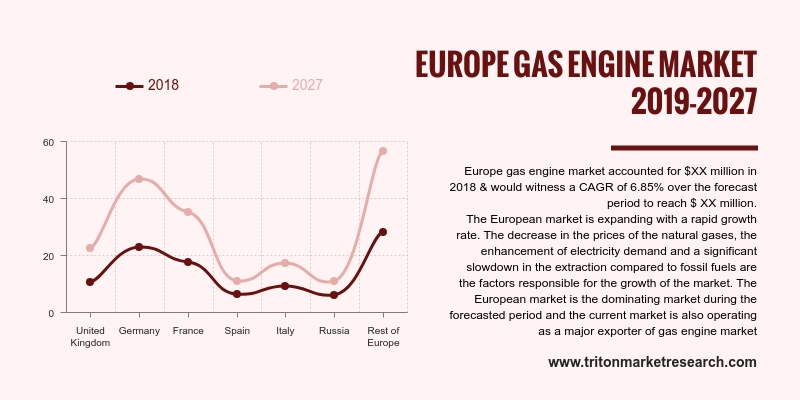

Triton’s research shows the European gas engine market to grow at a stable pace in terms of revenue, at a CAGR of 6.85%, during the forecast period 2019-2027.

The countries scrutinized in the Europe market for gas engines are:

• Russia

• Germany

• Italy

• France

• Spain

• The United Kingdom

• Rest of Europe

Report scope can be customized per your requirements. Request For Customization

Germany accounts for the majority of the share in the overall gas engine market in Europe. The country provides feed-in tariffs in the biogas segment – the key factor that aids in market expansion. Germany is the largest country for the biogas market, with around 7000 gas engines. Also, there are abundant resources available for the development of the gas engine market.

To act upon its ambitious goals of climate protection, the country has been planning to reduce its GHG emission levels by 2050, by about 80% to 95% from 1990. The increasing share of natural gas in the country’s energy mix would also help Germany to achieve these goals.

In addition, Germany houses several market giants in the automobile sector, such as Volkswagen, that have been encouraging the adoption of natural gas vehicles in the country. There has been an increase in the number of CNG vehicles being registered in the country each month since July 2017. This factor has been instrumental in raising the gas engine demand in Germany. Another factor influencing the demand is that the country is a pioneer in the entire European region for the development of renewables, energy storage, and electric vehicles.

Clarke Energy is a world-renowned brand in the energy sector. It distributes several power products and offers related services. It offers various types of engines such as gas engines, gas engine control, used gas engines, diesel gensets, and ancillary equipment are the various types of engines the company offers. The company also offers various types of gas, such as natural gas, coal gas, biogas, special gas, APG, and flare gas. Clarke Energy has its headquarters in Liverpool, the United Kingdom. In September 2018, the company installed its first biogas upgrading plant in France.

1. EUROPE

GAS ENGINE MARKET – SUMMARY

2. INDUSTRY

OUTLOOK

2.1. MARKET

DEFINITION

2.2. KEY

INSIGHTS

2.2.1. EUROPE

DOMINATES THE OVERALL MARKET

2.2.2. ADVENT

OF DUAL FUEL ENGINES

2.2.3. CONSUMPTION

OF ALTERNATE GASES AS FUELS

2.3. PORTER’S

FIVE FORCES ANALYSIS

2.3.1. THREAT

OF NEW ENTRANTS

2.3.2. THREAT

OF SUBSTITUTE

2.3.3. BARGAINING

POWER OF SUPPLIERS

2.3.4. BARGAINING

POWER OF BUYERS

2.3.5. THREAT

OF COMPETITIVE RIVALRY

2.4. KEY

IMPACT ANALYSIS

2.4.1. COST

2.4.2. EFFICIENCY

2.4.3. EMISSION

2.4.4. MAINTENANCE

2.4.5. FLEXIBILITY

2.5. MARKET

ATTRACTIVENESS INDEX

2.6. VENDOR

SCORECARD

2.7. REGULATORY

FRAMEWORK

2.8. MARKET

DRIVERS

2.8.1. DECREASE

IN GAS PRICES

2.8.2. GROWING

ELECTRICITY DEMAND WORLDWIDE

2.8.3. SURGE

IN ECOLOGICAL CONCERNS

2.8.4. INDUSTRIAL

EXPANSION LEADING TO ENVIRONMENTAL POWER GENERATION

2.9. MARKET

RESTRAINTS

2.9.1. ABNORMALITIES

IN NATURAL GAS RESERVES & PROVISIONS DUE TO REGIONAL INSTABILITY

2.9.2. RISE

IN SAFETY CONCERNS

2.9.3. PRICE

DISPARITY AMONG FUELS

2.10. MARKET

OPPORTUNITIES

2.10.1.

EMERGENT INCLINATION TOWARDS

DISTRIBUTED POWER GENERATION

2.10.2.

ADVENT OF GAS-FIRED POWER

PLANTS

2.11. MARKET

CHALLENGES

2.11.1.

DIMINISHING NATURAL GAS

RESERVES

2.11.2.

FIRM REGULATIONS LEVIED BY

AUTHORITIES

3. EUROPE

GAS ENGINE MARKET OUTLOOK – BY FUEL TYPE

3.1. NATURAL

GAS

3.2. SPECIAL

GAS

3.3. OTHER

GAS

4. EUROPE

GAS ENGINE MARKET OUTLOOK – BY POWER

4.1. 0.5

MW-1.0 MW

4.2. 1.0-2.0

MW

4.3. 2.0-5.0

MW

4.4. 5.0

MW-10.0 MW

4.5. 10.0

MW-20.0 MW

5. EUROPE

GAS ENGINE MARKET OUTLOOK – BY APPLICATION

5.1. POWER

GENERATION

5.2. CO-GENERATION

5.3. OTHER

APPLICATIONS

6. EUROPE

GAS ENGINE MARKET OUTLOOK – BY END-USER

6.1. UTILITIES

6.2. MANUFACTURING

6.3. OIL

& GAS

6.4. TRANSPORTATION

6.5. OTHER

END-USERS

7. EUROPE

GAS ENGINE MARKET – REGIONAL OUTLOOK

7.1. UNITED

KINGDOM

7.2. GERMANY

7.3. FRANCE

7.4. SPAIN

7.5. ITALY

7.6. RUSSIA

7.7. REST

OF EUROPE

8. COMPETITIVE

LANDSCAPE

8.1. 3W-INTERNATIONAL

GMBH

8.2. CATERPILLAR

INC.

8.3. CUMMINS INC.

8.4. CHINA

YUCHAI INTERNATIONAL LTD.

8.5. CLARKE

ENERGY

8.6. DEUTZ

AG

8.7. DRESSER-RAND

GROUP INC.

8.8. DOOSAN

INFRACORE CO. LTD.

8.9. FAIRBANKS

MORSE ENGINES

8.10. GENERAL

ELECTRIC COMPANY (INNIO)

8.11. HYUNDAI

HEAVY INDUSTRIES CO. LTD.

8.12. IHI

CORPORATION

8.13. KAWASAKI

HEAVY INDUSTRIES LTD.

8.14. MAN

SE

8.15. MITSUBISHI

HEAVY INDUSTRIES LTD.

8.16. WÄRTSILÄ

9. METHODOLOGY

& SCOPE

9.1. RESEARCH

SCOPE

9.2. SOURCES

OF DATA

9.3. RESEARCH

METHODOLOGY

TABLE 1: EUROPE GAS

ENGINE MARKET, BY COUNTRY, 2019-2027 (IN $ MILLION)

TABLE 2: VENDOR

SCORECARD

TABLE 3: REGULATORY

FRAMEWORK

TABLE 4: NATURAL GAS

PRICES (DOLLARS PER THOUSAND CUBIC FEET)

TABLE 5: COMPARISON OF

CARBON DIOXIDE EMISSION LEVELS FOR DIFFERENT FUELS (1990-2040) (MILLION METRIC

TONS)

TABLE 6: EUROPE GAS

ENGINE MARKET, BY FUEL TYPE, 2019-2027 (IN $ MILLION)

TABLE 7: EUROPE GAS

ENGINE MARKET, BY POWER, 2019-2027 (IN $ MILLION)

TABLE 8: EUROPE GAS

ENGINE MARKET, BY APPLICATION, 2019-2027 (IN $ MILLION)

TABLE 9: EUROPE GAS

ENGINE MARKET, BY END-USER, 2019-2027 (IN $ MILLION)

TABLE 10: EUROPE GAS

ENGINE MARKET, BY COUNTRY, 2019-2027 (IN $ MILLION)

FIGURE 1: EUROPE GAS

ENGINE MARKET, BY FUEL TYPE, 2018 & 2027 (IN %)

FIGURE 2: PORTER’S FIVE

FORCES ANALYSIS

FIGURE 3: KEY BUYING

IMPACT ANALYSIS

FIGURE 4: MARKET

ATTRACTIVENESS INDEX

FIGURE 5: EUROPE GAS ENGINE

MARKET, BY NATURAL GAS, 2019-2027 (IN $ MILLION)

FIGURE 6: EUROPE GAS

ENGINE MARKET, BY SPECIAL GAS, 2019-2027 (IN $ MILLION)

FIGURE 7: EUROPE GAS

ENGINE MARKET, BY OTHER GAS, 2019-2027 (IN $ MILLION)

FIGURE 8: EUROPE GAS

ENGINE MARKET, BY 0.5 MW-1.0 MW, 2019-2027 (IN $ MILLION)

FIGURE 9: EUROPE GAS

ENGINE MARKET, BY 1.0-2.0 MW, 2019-2027 (IN $ MILLION)

FIGURE 10: EUROPE GAS

ENGINE MARKET, BY 2.0-5.0 MW, 2019-2027 (IN $ MILLION)

FIGURE 11: EUROPE GAS

ENGINE MARKET, BY 5.0 MW-10.0 MW, 2019-2027 (IN $ MILLION)

FIGURE 12: EUROPE GAS

ENGINE MARKET, BY 10.0 MW-20.0 MW, 2019-2027 (IN $ MILLION)

FIGURE 13: EUROPE GAS

ENGINE MARKET, BY POWER GENERATION, 2019-2027 (IN $ MILLION)

FIGURE 14: EUROPE GAS

ENGINE MARKET, BY CO-GENERATION, 2019-2027 (IN $ MILLION)

FIGURE 15: EUROPE GAS

ENGINE MARKET, BY OTHER APPLICATIONS, 2019-2027 (IN $ MILLION)

FIGURE 16: EUROPE GAS

ENGINE MARKET, BY UTILITIES, 2019-2027 (IN $ MILLION)

FIGURE 17: EUROPE GAS

ENGINE MARKET, BY MANUFACTURING, 2019-2027 (IN $ MILLION)

FIGURE 18: EUROPE GAS

ENGINE MARKET, BY OIL & GAS, 2019-2027 (IN $ MILLION)

FIGURE 19: EUROPE GAS

ENGINE MARKET, BY TRANSPORTATION, 2019-2027 (IN $ MILLION)

FIGURE 20: EUROPE GAS

ENGINE MARKET, BY OTHER END-USERS, 2019-2027 (IN $ MILLION)

FIGURE 21: EUROPE GAS

ENGINE MARKET, REGIONAL OUTLOOK, 2018 & 2027 (IN %)

FIGURE 22: UNITED

KINGDOM GAS ENGINE MARKET, 2019-2027 (IN $ MILLION)

FIGURE 23: GERMANY GAS

ENGINE MARKET, 2019-2027 (IN $ MILLION)

FIGURE 24: FRANCE GAS

ENGINE MARKET, 2019-2027 (IN $ MILLION)

FIGURE 25: SPAIN GAS ENGINE

MARKET, 2019-2027 (IN $ MILLION)

FIGURE 26: ITALY GAS

ENGINE MARKET, 2019-2027 (IN $ MILLION)

FIGURE 27: RUSSIA GAS

ENGINE MARKET, 2019-2027 (IN $ MILLION)

FIGURE 28: REST OF

EUROPE GAS ENGINE MARKET, 2019-2027 (IN $ MILLION)