Market By Product, Technology And Geography | Forecast 2019-2027

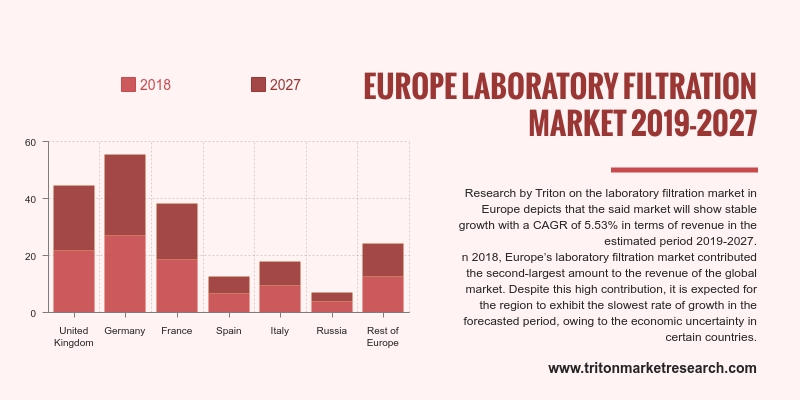

Research by Triton on the laboratory filtration market in Europe depicts that the said market will show stable growth with a CAGR of 5.53% in terms of revenue in the estimated period 2019-2027.

The countries reviewed in the European laboratory filtration market are:

• The United Kingdom

• Germany

• France

• Spain

• Italy

• Russia

• Rest of Europe

In 2018, Europe’s laboratory filtration market contributed the second-largest amount to the revenue of the global market. Despite this high contribution, it is expected for the region to exhibit the slowest rate of growth in the forecasted period, owing to the economic uncertainty in certain countries.

Report scope can be customized per your requirements. Request For Customization

While the countries of Germany and the UK have advanced facilities for research and innovation, the other countries in the region show stagnant growth with respect to research and testing. Moreover, these nations have the highest number of vendors of laboratory supplies & consumables in the region. The growth in the Europe laboratory filtration market is expected to be driven by the countries of the UK, France and Germany, which are expected to contribute the largest sums to the overall market revenue in the region. This growth would be supported by the economic stability, the relatively larger talent pool and better labor reforms in these countries.

The pharmaceutical industry in the United Kingdom invested $426.32 million for research and development activities in the country in 2017, with an increase of 9.7%, as compared to 2016. The UK government’s industrial strategy aims at bringing universities together with small, medium and large-scale enterprises for collaborating and committing to further investment are expected to drive the market in the United Kingdom.

MACHEREY-NAGEL provides innovative, reliable and superior quality products for chemical and biomolecular analysis. Products from the company are used for rapid tests, filtration, water analysis, bioanalysis and chromatography. MACHEREY-NAGEL has designed and manufactured over 20,000 products catering to individual needs. It is headquartered in Düren, Germany.

1. EUROPE

LABORATORY FILTRATION MARKET - SUMMARY

2. INDUSTRY

OUTLOOK

2.1. MARKET

DEFINITION

2.2. KEY

INSIGHTS

2.2.1. FILTRATION

MEDIA HAS THE HIGHEST CONTRIBUTION IN THE PRODUCT CATEGORY

2.2.2. NANOFILTRATION

IS THE FASTEST-GROWING TECHNOLOGY DURING THE FORECAST PERIOD

2.3. PORTER’S

FIVE FORCES ANALYSIS

2.3.1. THREAT

OF NEW ENTRANTS

2.3.2. THREAT

OF SUBSTITUTE

2.3.3. BARGAINING

POWER OF SUPPLIERS

2.3.4. BARGAINING

POWER OF BUYERS

2.3.5. INTENSITY

OF COMPETITIVE RIVALRY

2.4. MARKET

ATTRACTIVENESS INDEX

2.5. VENDOR

SCORECARD

2.6. MARKET

DRIVERS

2.6.1. INTRODUCTION

OF PRODUCTS WITH ADVANCED TECHNOLOGY

2.6.2. APPLICATION

OF LABORATORY FILTRATION IN THE FOOD & BEVERAGE INDUSTRY

2.6.3. GROWTH

IN THE USAGE OF FILTRATION IN CLINICAL LABORATORIES

2.6.4. GROWING

RESEARCH ACTIVITIES IN THE BIOPHARMACEUTICAL SECTOR

2.7. MARKET

RESTRAINTS

2.7.1. LOW

AVAILABILITY OF SPECIALIZED, SKILLED AND TRAINED PROFESSIONALS

2.7.2. HIGH

INITIAL INVESTMENT

2.8. MARKET

OPPORTUNITIES

2.8.1. RISING

DEMAND FOR FILTRATION EQUIPMENT

2.8.2. INCREASE

IN THE PREFERENCE FOR MEMBRANE FILTRATION TECHNOLOGY

2.9. MARKET

CHALLENGES

2.9.1. TIME-CONSUMING

FILTER VALIDATION REGULATIONS

2.9.2. STAGNATION

IN INNOVATION

2.9.3. LESS

DIFFERENTIATION AMONGST THE PRODUCTS

2.9.4. HIGH

IMPORT DUTIES

3. LABORATORY

FILTRATION MARKET OUTLOOK - BY PRODUCT

3.1. FILTRATION

MEDIA

3.1.1. MEMBRANE

FILTERS

3.1.2. FILTER

PAPERS

3.1.3. SYRINGE

FILTERS

3.1.4. SYRINGELESS

FILTERS

3.1.5. CAPSULE

FILTERS

3.1.6. FILTRATION

MICROPLATES

3.1.7. OTHER

FILTRATION MEDIA

3.2. FILTRATION

ASSEMBLIES

3.2.1. ULTRAFILTRATION

ASSEMBLIES

3.2.2. MICROFILTRATION

3.2.3. VACUUM

FILTRATION

3.2.4. REVERSE

OSMOSIS

3.2.5. OTHER

FILTRATION ASSEMBLIES

3.3. FILTRATION

ACCESSORIES

3.3.1. FILTER

HOLDERS MEDIA

3.3.2. FILTER

DISPENSERS

3.3.3. FILTER

FLASKS

3.3.4. CARTRIDGE

FILTERS

3.3.5. FILTER

FUNNEL

3.3.6. FILTER

HOUSINGS

3.3.7. FILTER

SEALS

3.3.8. VACUUM

PUMPS

3.3.9. OTHER

ACCESSORIES

4. LABORATORY

FILTRATION MARKET OUTLOOK - BY TECHNOLOGY

4.1. MICROFILTRATION

4.2. NANOFILTRATION

4.3. VACUUM

FILTRATION

4.4. ULTRAFILTRATION

4.5. REVERSE

OSMOSIS TECHNOLOGY

4.6. OTHER

TECHNOLOGIES

5. LABORATORY

FILTRATION MARKET - EUROPE

5.1. THE

UNITED KINGDOM

5.2. GERMANY

5.3. FRANCE

5.4. SPAIN

5.5. ITALY

5.6. RUSSIA

5.7. REST

OF EUROPE

6. COMPETITIVE

LANDSCAPE

6.1. SARTORIUS

GROUP

6.2. GE

HEALTHCARE

6.3. THERMO

FISHER SCIENTIFIC

6.4. SIGMA-ALDRICH

CORPORATION

6.5. MACHEREY-NAGEL

6.6. CANTEL

MEDICAL CORPORATION

6.7. 3M

COMPANY

6.8. PALL

CORPORATION

6.9. MERCK

MILLIPORE

7. RESEARCH

METHODOLOGY & SCOPE

7.1. RESEARCH

SCOPE & DELIVERABLES

7.1.1. OBJECTIVES

OF STUDY

7.1.2. SCOPE

OF STUDY

7.2. SOURCES

OF DATA

7.2.1. PRIMARY

DATA SOURCES

7.2.2. SECONDARY

DATA SOURCES

7.3. RESEARCH

METHODOLOGY

7.3.1. EVALUATION

OF PROPOSED MARKET

7.3.2. IDENTIFICATION

OF DATA SOURCES

7.3.3. ASSESSMENT

OF MARKET DETERMINANTS

7.3.4. DATA

COLLECTION

7.3.5. DATA

VALIDATION & ANALYSIS

TABLE 1: EUROPE

LABORATORY FILTRATION MARKET, BY COUNTRY, 2019-2027 (IN $ MILLION)

TABLE 2: VENDOR

SCORECARD

TABLE 3: EUROPE

LABORATORY FILTRATION MARKET, BY PRODUCT, 2019-2027 (IN $ MILLION)

TABLE 4: EUROPE FILTRATION

MEDIA MARKET, BY TYPE, 2019-2027 (IN $ MILLION)

TABLE 5: EUROPE

FILTRATION ASSEMBLIES MARKET, BY TYPE, 2019-2027 (IN $ MILLION)

TABLE 6: EUROPE

FILTRATION ACCESSORIES MARKET, BY TYPE, 2019-2027 (IN $ MILLION)

TABLE 7: EUROPE

LABORATORY FILTRATION MARKET, BY TECHNOLOGY, 2019-2027 (IN $ MILLION)

TABLE 8: EUROPE

LABORATORY FILTRATION MARKET, BY COUNTRY, 2019-2027 (IN $ MILLION)

FIGURE 1: EUROPE

LABORATORY FILTRATION MARKET, BY APPLICATION, 2018 & 2027 (IN %)

FIGURE 2: EUROPE

FILTRATION MEDIA MARKET, 2019-2027 (IN $ MILLION)

FIGURE 3: EUROPE

NANOFILTRATION MARKET, 2019-2027 (IN $ MILLION)

FIGURE 4: PORTER’S FIVE

FORCES ANALYSIS

FIGURE 5: MARKET

ATTRACTIVENESS INDEX

FIGURE 6: EUROPE

LABORATORY FILTRATION MARKET, BY FILTRATION MEDIA, 2019-2027 (IN $ MILLION)

FIGURE 7: EUROPE

LABORATORY FILTRATION MARKET, BY MEMBRANE FILTERS, 2019-2027 (IN $ MILLION)

FIGURE 8: EUROPE

LABORATORY FILTRATION MARKET, BY FILTER PAPERS, 2019-2027 (IN $ MILLION)

FIGURE 9: EUROPE

LABORATORY FILTRATION MARKET, BY SYRINGE FILTERS, 2019-2027 (IN $ MILLION)

FIGURE 10: EUROPE

LABORATORY FILTRATION MARKET, BY SYRINGELESS FILTERS, 2019-2027 (IN $ MILLION)

FIGURE 11: EUROPE

LABORATORY FILTRATION MARKET, BY CAPSULE FILTERS, 2019-2027 (IN $ MILLION)

FIGURE 12: EUROPE

LABORATORY FILTRATION MARKET, BY FILTRATION MICROPLATES, 2019-2027 (IN $

MILLION)

FIGURE 13: EUROPE

LABORATORY FILTRATION MARKET, BY OTHER FILTRATION MEDIA, 2019-2027 (IN $ MILLION)

FIGURE 14: EUROPE

LABORATORY FILTRATION MARKET, BY FILTRATION ASSEMBLIES, 2019-2027 (IN $

MILLION)

FIGURE 15: EUROPE

LABORATORY FILTRATION MARKET, BY ULTRAFILTRATION ASSEMBLIES, 2019-2027 (IN $

MILLION)

FIGURE 16: EUROPE

LABORATORY FILTRATION MARKET, BY MICROFILTRATION ASSEMBLIES, 2019-2027 (IN $

MILLION)

FIGURE 17: EUROPE

LABORATORY FILTRATION MARKET, BY VACUUM FILTRATION, 2019-2027 (IN $ MILLION)

FIGURE 18: EUROPE

LABORATORY FILTRATION MARKET, BY REVERSE OSMOSIS, 2019-2027 (IN $ MILLION)

FIGURE 19: EUROPE

LABORATORY FILTRATION MARKET, BY OTHER FILTRATION ASSEMBLIES, 2019-2027 (IN $

MILLION)

FIGURE 20: EUROPE

LABORATORY FILTRATION MARKET, BY FILTRATION ACCESSORIES, 2019-2027 (IN $

MILLION)

FIGURE 21: EUROPE

LABORATORY FILTRATION MARKET, BY FILTER HOLDERS MEDIA, 2019-2027 (IN $ MILLION)

FIGURE 22: EUROPE

LABORATORY FILTRATION MARKET, BY FILTER DISPENSERS, 2019-2027 (IN $ MILLION)

FIGURE 23: EUROPE

LABORATORY FILTRATION MARKET, BY FILTER FLASKS, 2019-2027 (IN $ MILLION)

FIGURE 24: EUROPE LABORATORY

FILTRATION MARKET, BY CARTRIDGE FILTERS, 2019-2027 (IN $ MILLION)

FIGURE 25: EUROPE

LABORATORY FILTRATION MARKET, BY FILTER FUNNEL, 2019-2027 (IN $ MILLION)

FIGURE 26: EUROPE

LABORATORY FILTRATION MARKET, BY FILTER HOUSINGS, 2019-2027 (IN $ MILLION)

FIGURE 27: EUROPE

LABORATORY FILTRATION MARKET, BY FILTER SEALS, 2019-2027 (IN $ MILLION)

FIGURE 28: EUROPE

LABORATORY FILTRATION MARKET, BY VACUUM PUMPS, 2019-2027 (IN $ MILLION)

FIGURE 29: EUROPE

LABORATORY FILTRATION MARKET, BY OTHER ACCESSORIES, 2019-2027 (IN $ MILLION)

FIGURE 30: EUROPE

LABORATORY FILTRATION MARKET, BY MICROFILTRATION, 2019-2027 (IN $ MILLION)

FIGURE 31: EUROPE

LABORATORY FILTRATION MARKET, BY NANOFILTRATION, 2019-2027 (IN $ MILLION)

FIGURE 32: EUROPE

LABORATORY FILTRATION MARKET, BY VACUUM FILTRATION TECHNOLOGY, 2019-2027 (IN $

MILLION)

FIGURE 33: EUROPE

LABORATORY FILTRATION MARKET, BY ULTRAFILTRATION TECHNOLOGY, 2019-2027 (IN $

MILLION)

FIGURE 34: EUROPE

LABORATORY FILTRATION MARKET, BY REVERSE OSMOSIS TECHNOLOGY, 2019-2027 (IN $

MILLION)

FIGURE 35: EUROPE

LABORATORY FILTRATION MARKET, BY OTHER TECHNOLOGIES, 2019-2027 (IN $ MILLION)

FIGURE 36: EUROPE

LABORATORY FILTRATION MARKET, REGIONAL OUTLOOK, 2018 & 2027 (IN %)

FIGURE 37: THE UNITED

KINGDOM LABORATORY FILTRATION MARKET, 2019-2027 (IN $ MILLION)

FIGURE 38: GERMANY

LABORATORY FILTRATION MARKET, 2019-2027 (IN $ MILLION)

FIGURE 39: FRANCE

LABORATORY FILTRATION MARKET, 2019-2027 (IN $ MILLION)

FIGURE 40: SPAIN

LABORATORY FILTRATION MARKET, 2019-2027 (IN $ MILLION)

FIGURE 41: ITALY

LABORATORY FILTRATION MARKET, 2019-2027 (IN $ MILLION)

FIGURE 42: RUSSIA

LABORATORY FILTRATION MARKET, 2019-2027 (IN $ MILLION)

FIGURE 43: REST OF

EUROPE LABORATORY FILTRATION MARKET, 2019-2027 (IN $ MILLION)