Market by Product, Type, End-user, and Geography | Forecast 2019-2027

After a detailed analysis, Triton has concluded that the global lead-acid battery market is expected to display an upward trend in terms of revenue. In addition, it is estimated to grow at a CAGR of 3.10% during the forecasting years 2019 to 2027. The market accounted for $47605 million in 2018 and is expected to reach $62603 million by 2027.

Lead-acid batteries can be categorized as wet batteries as they contain an electrolyte that stores electrical energy. Lead electrodes are submerged in diluted sulfuric acid (the electrolyte). Though lead-acid batteries have low energy-to-weight and energy-to-volume ratios, they can supply tremendous current surges (the maximum input current drawn by an electrical device). These batteries are also cost-effective.

Low cost and high sustainability of the lead-acid batteries are the major factors helping in the growth of the market. Lead-acid batteries costs are low as compared to other batteries such as lithium-ion batteries, sodium-sulfur batteries, and others. This factor helps in its adoption of the automotive industry. Lead-acid batteries’ cost, life-span, and performance vary depending upon the mechanical (lead plate) and chemical design (sulfuric acid). The lifetime cost of the lead-acid battery is low as compared to lithium-ion batteries (their alternative), which range about $XX-$XX per kWh. Secondly, lead-acid batteries have high sustainability as compared to other batteries such as NiMH, Li-ion batteries. These lead-acid batteries are highly sustainable as they are completely recycled and give an economic advantage. All lead-acid batteries are made either from sulfuric acid or from advanced lead-carbon technology and are recyclable.

The lead-acid battery market report from Triton gives a detailed analysis of market definition, key insights, evolution & transition of the lead-acid battery, Porter’s five forces analysis, key impact analysis, market attractiveness index, vendor scorecard, industry components, and the regulatory framework.

Key opportunities such as the growth of off-grid renewable energy generation and the increased use of SLA batteries in data centers are leveraging the market growth over the projected period. Both of these sectors will require energy storage devices. Lead-acid batteries will benefit from growth in these two sectors.

The slowdown in the automotive sector and problems due to lead pollution are the key restraints and challenges curbing the growth of the market globally. Automotive is the major sector for the lead-acid battery market. Lead-acid batteries are used in SLI (Start Lighting & Ignition) applications in automobiles. This sector is showing signs of a slowdown and in the past year, showed negative growth. This is a major restraining factor for the lead-acid battery market.

Geographies covered for the lead-acid battery market:

• North America: United States and Canada

• Europe: United Kingdom, Germany, France, Italy, Spain, Russia and Rest of Europe

• Asia-Pacific: China, Japan, India, South Korea, ASEAN countries, Australia & New Zealand and Rest of Asia-Pacific

• Latin America: Brazil, Mexico and Rest of Latin America

• The Middle East and Africa: United Arab Emirates, Turkey, Saudi Arabia, South Africa and Rest of the Middle East & Africa

The lead-acid battery market, in this report, is segmented as follows:

• Product is sub-segmented into:

O SLI Batteries

O Micro-Hybrid Batteries

• Type is sub-segmented into:

O Flooded Batteries

O Enhanced Flooded Batteries

O VRLA Batteries

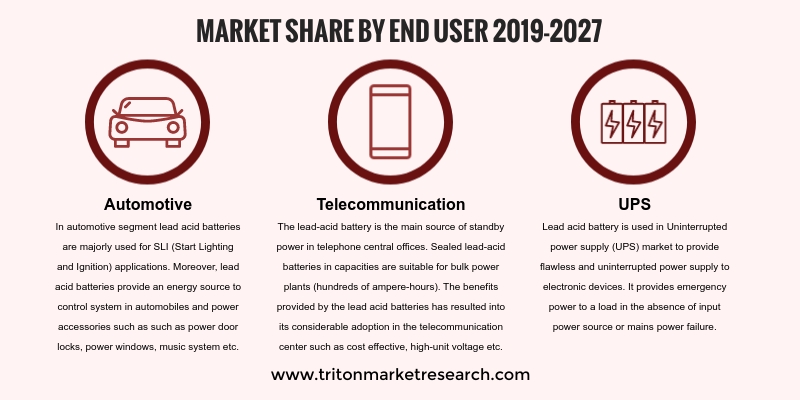

• End-user is sub-segmented into:

O Automotive

O Telecommunication

O UPS

O Others

The companies that have been mentioned in the lead-acid battery market report are Zibo Torch Energy Co., Ltd., B.B. Battery Co., Toshiba Corporation, EnerSys, Narada Power Source Co., Ltd., Clarios (Formerly Johnsons Controls Power Solutions), NorthStar, Exide Technologies, Inc., CSB Battery Company Ltd. (acquired by Hitachi Chemical Energy Technology), East Penn Manufacturing, Crown Battery, C&D Technologies Inc. (KPS Capital Partner), GS Yuasa Corporation, Nipress, and Reem Batteries & Power Appliances Co. SAOC.

The strategic analysis for each of these companies in the lead-acid battery market has been covered in detail.

1. GLOBAL

LEAD—ACID BATTERY MARKET – SUMMARY

2. INDUSTRY

OUTLOOK

2.1. MARKET

DEFINITION

2.2. KEY

INSIGHTS

2.2.1. RELIABLE

PERFORMANCE OF LEAD—ACID BATTERIES INCREASES THEIR SALES

2.2.2. LOW

ENERGY DENSITY OF LEAD—ACID BATTERY REDUCES THEIR SELLING POTENTIAL

2.2.3. VRLA

BATTERIES ARE FASTEST-GROWING LEAD—ACID BATTERIES BY TYPE

2.3. EVOLUTION

& TRANSITION OF LEAD—ACID BATTERY

2.4. PORTER’S

FIVE FORCES ANALYSIS

2.4.1. THREAT

OF NEW ENTRANTS

2.4.2. THREAT

OF SUBSTITUTE

2.4.3. BARGAINING

POWER OF SUPPLIERS

2.4.4. BARGAINING

POWER OF BUYERS

2.4.5. THREAT

OF COMPETITIVE RIVALRY

2.5. KEY

IMPACT ANALYSIS

2.5.1. APPLICATION

2.5.2. COST

2.5.3. LIFE

SPAN

2.6. MARKET

ATTRACTIVENESS INDEX

2.7. VENDOR

SCORECARD

2.8. INDUSTRY

COMPONENTS

2.9. REGULATORY

FRAMEWORK

2.10. MARKET

DRIVERS

2.10.1.

COMPARATIVELY LOW COST

2.10.2.

HIGH SUSTAINABILITY AS

COMPARED TO ALTERNATIVE PRODUCTS

2.10.3.

GROWING DEMAND FROM HYBRID

ELECTRIC VEHICLES

2.11. MARKET

RESTRAINTS

2.11.1.

SLOWDOWN IN AUTOMOTIVE SECTOR

2.11.2.

INCREASING LEAD POLLUTION

2.12. MARKET

OPPORTUNITIES

2.12.1.

GROWTH OF OFF-GRID RENEWABLE

ENERGY GENERATION

2.12.2.

INCREASING USE OF SLA

BATTERIES IN DATA CENTERS

2.13. MARKET

CHALLENGES

2.13.1.

ADOPTION OF DRY BATTERIES

3. GLOBAL

LEAD—ACID BATTERY MARKET OUTLOOK – BY PRODUCT

3.1. SLI

BATTERIES

3.2. MICRO

HYBRID BATTERIES

4. GLOBAL

LEAD—ACID BATTERY MARKET OUTLOOK – BY TYPE

4.1. FLOODED

BATTERIES

4.2. ENHANCED

FLOODED BATTERIES

4.3. VRLA

BATTERIES

5. GLOBAL

LEAD—ACID BATTERY MARKET OUTLOOK – BY END-USER

5.1. AUTOMOTIVE

5.2. TELECOMMUNICATION

5.3. UPS

5.4. OTHERS

6. GLOBAL

LEAD—ACID BATTERY MARKET – REGIONAL OUTLOOK

6.1. NORTH

AMERICA

6.1.1. MARKET

BY PRODUCT

6.1.2. MARKET

BY TYPE

6.1.3. MARKET

BY END-USER

6.1.4. COUNTRY

ANALYSIS

6.1.4.1. UNITED

STATES

6.1.4.2. CANADA

6.2. EUROPE

6.2.1. MARKET

BY PRODUCT

6.2.2. MARKET

BY TYPE

6.2.3. MARKET

BY END-USER

6.2.4. COUNTRY

ANALYSIS

6.2.4.1. UNITED

KINGDOM

6.2.4.2. GERMANY

6.2.4.3. FRANCE

6.2.4.4. SPAIN

6.2.4.5. ITALY

6.2.4.6. RUSSIA

6.2.4.7. REST

OF EUROPE

6.3. ASIA-PACIFIC

6.3.1. MARKET

BY PRODUCT

6.3.2. MARKET

BY TYPE

6.3.3. MARKET

BY END-USER

6.3.4. COUNTRY

ANALYSIS

6.3.4.1. CHINA

6.3.4.2. JAPAN

6.3.4.3. INDIA

6.3.4.4. SOUTH

KOREA

6.3.4.5. ASEAN

COUNTRIES

6.3.4.6. AUSTRALIA

& NEW ZEALAND

6.3.4.7. REST

OF ASIA-PACIFIC

6.4. LATIN

AMERICA

6.4.1. MARKET

BY PRODUCT

6.4.2. MARKET

BY TYPE

6.4.3. MARKET

BY END-USER

6.4.4. COUNTRY

ANALYSIS

6.4.4.1. BRAZIL

6.4.4.2. MEXICO

6.4.4.3. REST

OF LATIN AMERICA

6.5. MIDDLE

EAST AND AFRICA

6.5.1. MARKET

BY PRODUCT

6.5.2. MARKET

BY TYPE

6.5.3. MARKET

BY END-USER

6.5.4. COUNTRY

ANALYSIS

6.5.4.1. UNITED

ARAB EMIRATES

6.5.4.2. TURKEY

6.5.4.3. SAUDI

ARABIA

6.5.4.4. SOUTH

AFRICA

6.5.4.5. REST

OF MIDDLE EAST & AFRICA

7. COMPETITIVE

LANDSCAPE

7.1. B.B.

BATTERY CO.

7.2. C&D

TECHNOLOGIES, INC. (ACQUIRED BY KPS CAPITAL PARTNER)

7.3. CROWN

BATTERY

7.4. CSB

BATTERY COMPANY LTD. (ACQUIRED BY HITACHI CHEMICAL ENERGY TECHNOLOGY)

7.5. EAST

PENN MANUFACTURING

7.6. ENERSYS

7.7. EXIDE

TECHNOLOGIES, INC.

7.8. GS

YUASA CORPORATION

7.9. CLARIOS

(FORMERLY JOHNSONS CONTROLS POWER SOLUTIONS)

7.10. NARADA

POWER SOURCE CO., LTD.

7.11. NIPRESS

7.12. NORTHSTAR

7.13. TOSHIBA

CORPORATION

7.14. ZIBO

TORCH ENERGY CO., LTD.

7.15. REEM

BATTERIES & POWER APPLIANCES CO. SAOC

8. RESEARCH

METHODOLOGY & SCOPE

8.1. RESEARCH

SCOPE & DELIVERABLES

8.2. SOURCES

OF DATA

8.3. RESEARCH

METHODOLOGY

TABLE 1: GLOBAL

LEAD—ACID BATTERY MARKET, BY GEOGRAPHY, 2019-2027 (IN $ MILLION)

TABLE 2: BATTERY

TECHNOLOGY COMPARISON

TABLE 3: VENDOR

SCORECARD

TABLE 4: REGULATORY

FRAMEWORK

TABLE 5: TECHNICAL

PERFORMANCE COMPARISON OF BATTERY

TABLE 6: WORLDWIDE

LITHIUM-ION BATTERY CAPACITY

TABLE 7: GLOBAL

LEAD—ACID BATTERY MARKET, BY PRODUCT, 2019-2027 (IN $ MILLION)

TABLE 8: GLOBAL

LEAD—ACID BATTERY MARKET, BY TYPE, 2019-2027 (IN $ MILLION)

TABLE 9: GLOBAL

LEAD—ACID BATTERY MARKET, BY END-USER, 2019-2027 (IN $ MILLION)

TABLE 10: GLOBAL

LEAD—ACID BATTERY MARKET, BY GEOGRAPHY, 2019-2027 (IN $ MILLION)

TABLE 11: NORTH AMERICA

LEAD—ACID BATTERY MARKET, BY COUNTRY, 2019-2027 (IN $ MILLION)

TABLE 12: NORTH AMERICA

LEAD—ACID BATTERY MARKET, BY PRODUCT, 2019-2027 (IN $ MILLION)

TABLE 13: NORTH AMERICA

LEAD—ACID BATTERY MARKET, BY TYPE, 2019-2027 (IN $ MILLION)

TABLE 14: NORTH AMERICA

LEAD—ACID BATTERY MARKET, BY END-USER, 2019-2027 (IN $ MILLION)

TABLE 15: EUROPE

LEAD—ACID BATTERY MARKET, BY COUNTRY, 2019-2027 (IN $ MILLION)

TABLE 16: EUROPE

LEAD—ACID BATTERY MARKET, BY PRODUCT, 2019-2027 (IN $ MILLION)

TABLE 17: EUROPE

LEAD—ACID BATTERY MARKET, BY TYPE, 2019-2027 (IN $ MILLION)

TABLE 18: EUROPE

LEAD—ACID BATTERY MARKET, BY END-USER, 2019-2027 (IN $ MILLION)

TABLE 19: ASIA-PACIFIC

LEAD—ACID BATTERY MARKET, BY COUNTRY, 2019-2027 (IN $ MILLION)

TABLE 20: ASIA-PACIFIC

LEAD—ACID BATTERY MARKET, BY PRODUCT, 2019-2027 (IN $ MILLION)

TABLE 21: ASIA-PACIFIC

LEAD—ACID BATTERY MARKET, BY TYPE, 2019-2027 (IN $ MILLION)

TABLE 22: ASIA-PACIFIC LEAD—ACID

BATTERY MARKET, BY END-USER, 2019-2027 (IN $ MILLION)

TABLE 23: LATIN AMERICA

LEAD—ACID BATTERY MARKET, BY COUNTRY, 2019-2027 (IN $ MILLION)

TABLE 24: LATIN AMERICA

LEAD—ACID BATTERY MARKET, BY PRODUCT, 2019-2027 (IN $ MILLION)

TABLE 25: LATIN AMERICA

LEAD—ACID BATTERY MARKET, BY TYPE, 2019-2027 (IN $ MILLION)

TABLE 26: LATIN AMERICA

LEAD—ACID BATTERY MARKET, BY END-USER, 2019-2027 (IN $ MILLION)

TABLE 27: MIDDLE EAST

AND AFRICA LEAD—ACID BATTERY MARKET, BY COUNTRY, 2019-2027 (IN $ MILLION)

TABLE 28: MIDDLE EAST

AND AFRICA LEAD—ACID BATTERY MARKET, BY PRODUCT, 2019-2027 (IN $ MILLION)

TABLE 29: MIDDLE EAST

AND AFRICA LEAD—ACID BATTERY MARKET, BY TYPE, 2019-2027 (IN $ MILLION)

TABLE 30: MIDDLE EAST

AND AFRICA LEAD—ACID BATTERY MARKET, BY END-USER, 2019-2027 (IN $ MILLION)

FIGURE 1: RECYCLING

RATES-PERCENTAGE OF RECLAIMED MATERIAL IN UNITED STATES

FIGURE 2: TIMELINE OF

LEAD—ACID BATTERY

FIGURE 3: PORTER’S FIVE

FORCES ANALYSIS

FIGURE 4: KEY BUYING

IMPACT ANALYSIS

FIGURE 5: MARKET

ATTRACTIVENESS INDEX

FIGURE 6: INDUSTRY

COMPONENTS

FIGURE 7: ENERGY

CONSUMPTION BY BATTERIES IN MEGAJOULES PER KG

FIGURE 8: AVERAGE CO2

EMISSIONS PER KG BY BATTERY TECHNOLOGIES

FIGURE 9: GLOBAL

LEAD—ACID BATTERY MARKET, BY SLI BATTERIES, 2019-2027 (IN $ MILLION)

FIGURE 10: GLOBAL

LEAD—ACID BATTERY MARKET, BY MICRO HYBRID BATTERIES, 2019-2027 (IN $ MILLION)

FIGURE 11: GLOBAL

LEAD—ACID BATTERY MARKET, BY FLOODED BATTERIES, 2019-2027 (IN $ MILLION)

FIGURE 12: GLOBAL

LEAD—ACID BATTERY MARKET, BY ENHANCED FLOODED BATTERIES, 2019-2027 (IN $

MILLION)

FIGURE 13: GLOBAL

LEAD—ACID BATTERY MARKET, BY VRLA BATTERIES, 2019-2027 (IN $ MILLION)

FIGURE 14: GLOBAL

LEAD—ACID BATTERY MARKET, BY AUTOMOTIVE, 2019-2027 (IN $ MILLION)

FIGURE 15: GLOBAL

LEAD—ACID BATTERY MARKET, BY TELECOMMUNICATION, 2019-2027 (IN $ MILLION)

FIGURE 16: GLOBAL

LEAD—ACID BATTERY MARKET, BY UPS, 2019-2027 (IN $ MILLION)

FIGURE 17: GLOBAL

LEAD—ACID BATTERY MARKET, BY OTHERS, 2019-2027 (IN $ MILLION)

FIGURE 18: GLOBAL

LEAD—ACID BATTERY MARKET, REGIONAL OUTLOOK, 2018 & 2027 (IN %)

FIGURE 19: UNITED

STATES LEAD—ACID BATTERY MARKET, 2019-2027 (IN $ MILLION)

FIGURE 20: CANADA

LEAD—ACID BATTERY MARKET, 2019-2027 (IN $ MILLION)

FIGURE 21: UNITED

KINGDOM LEAD—ACID BATTERY MARKET, 2019-2027 (IN $ MILLION)

FIGURE 22: GERMANY

LEAD—ACID BATTERY MARKET, 2019-2027 (IN $ MILLION)

FIGURE 23: FRANCE

LEAD—ACID BATTERY MARKET, 2019-2027 (IN $ MILLION)

FIGURE 24: SPAIN

LEAD—ACID BATTERY MARKET, 2019-2027 (IN $ MILLION)

FIGURE 25: ITALY

LEAD—ACID BATTERY MARKET, 2019-2027 (IN $ MILLION)

FIGURE 26: RUSSIA

LEAD—ACID BATTERY MARKET, 2019-2027 (IN $ MILLION)

FIGURE 27: REST OF

EUROPE LEAD—ACID BATTERY MARKET, 2019-2027 (IN $ MILLION)

FIGURE 28: CHINA

LEAD—ACID BATTERY MARKET, 2019-2027 (IN $ MILLION)

FIGURE 29: JAPAN

LEAD—ACID BATTERY MARKET, 2019-2027 (IN $ MILLION)

FIGURE 30: INDIA

LEAD—ACID BATTERY MARKET, 2019-2027 (IN $ MILLION)

FIGURE 31: SOUTH KOREA

LEAD—ACID BATTERY MARKET, 2019-2027 (IN $ MILLION)

FIGURE 32: ASEAN

COUNTRIES LEAD—ACID BATTERY MARKET, 2019-2027 (IN $ MILLION)

FIGURE 33: AUSTRALIA

& NEW ZEALAND LEAD—ACID BATTERY MARKET, 2019-2027 (IN $ MILLION)

FIGURE 34: REST OF

ASIA-PACIFIC LEAD—ACID BATTERY MARKET, 2019-2027 (IN $ MILLION)

FIGURE 35: BRAZIL

LEAD—ACID BATTERY MARKET, 2019-2027 (IN $ MILLION)

FIGURE 36: MEXICO

LEAD—ACID BATTERY MARKET, 2019-2027 (IN $ MILLION)

FIGURE 37: REST OF

LATIN AMERICA LEAD—ACID BATTERY MARKET, 2019-2027 (IN $ MILLION)

FIGURE 38: UNITED ARAB

EMIRATES LEAD—ACID BATTERY MARKET, 2019-2027 (IN $ MILLION)

FIGURE 39: TURKEY

LEAD—ACID BATTERY MARKET, 2019-2027 (IN $ MILLION)

FIGURE 40: SAUDI ARABIA

LEAD—ACID BATTERY MARKET, 2019-2027 (IN $ MILLION)

FIGURE 41: SOUTH AFRICA

LEAD—ACID BATTERY MARKET, 2019-2027 (IN $ MILLION)

FIGURE 42: REST OF

MIDDLE EAST & AFRICA LEAD—ACID BATTERY MARKET, 2019-2027 (IN $ MILLION)