Market by Product, Type, End-user, and Geography | Forecast 2019-2027

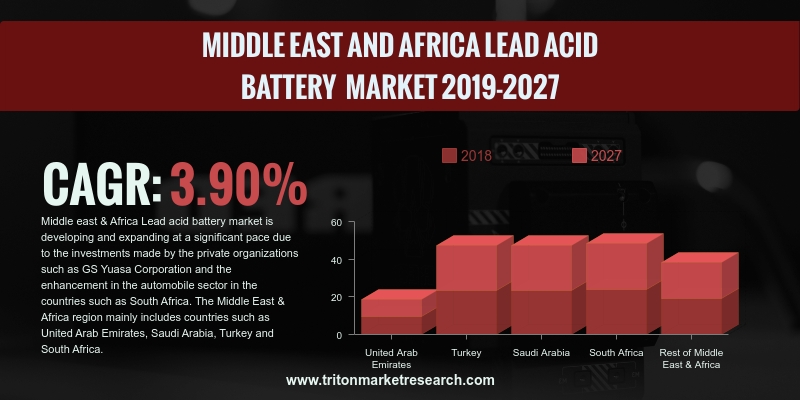

As per the Triton report on the Middle East and Africa lead-acid battery market, the industry is anticipated to surge at a CAGR of 3.90% in the forecast years of 2019-2027.

The countries assessed in the report on the lead-acid battery market in the Middle East and Africa are:

• Turkey

• United Arab Emirates

• South Africa

• Saudi Arabia

• Rest of Middle East Africa

South Africa held the majority of the market share of 24.12% in the region in 2018. The country has witnessed an increase in demand for automobiles in recent years. As per the Bureau of Transportation Statistics, around 248 million passenger and commercial vehicles were produced in South Africa in 2015. Lead-acid batteries have applications in automobiles for facilitating the start-stop operations, and thus, the large-scale production of automobiles would raise the demand for lead-acid batteries. The increased demand will drive the growth of the lead-acid battery market in South Africa.

The country also has one of the most advanced telecommunications sectors in the African region; there has been an increased proliferation of smartphones, growth in internet penetration, and enhanced connectivity in the country in the past decade. An uninterrupted power supply is required for telecommunication services to function efficiently. Sealed lead-acid batteries are used for power back-up in the telecom sector. Thus, the development of the telecom sector would propel the growth of South Africa’s lead-acid battery market. Meanwhile, Saudi Arabia is focusing on the complete transition to renewable energy systems by 2040, and the government of the country has been making heavy investments for this purpose. The cost-effectiveness and durability of lead-acid batteries makes them an attractive option for use in renewable energy systems. Thus, the expansion of the renewable energy sector opens up growth avenues for the lead-acid battery market in the country.

GS Yuasa Corporation is a leading company manufacturing lead-acid batteries. It is planning to expand its base in the Middle East by establishing a new plant in Turkey for the production of lead-acid batteries. GS Yuasa has four main divisions in which it operates: Domestic Automotive Batteries; Industrial Batteries & Power Supplies; Lithium-Ion Batteries; and Overseas Operations. It provides lead-acid batteries for use in automotive as well as for industrial use. Established in 2004, the company provides a broad range of products. It sells valve-regulated lead-acid batteries under the PE/PX/PXL Series, PWL & PYL Series, and SWL & FXH Series.

1. MIDDLE

EAST AND AFRICA LEAD—ACID BATTERY MARKET – SUMMARY

2. INDUSTRY

OUTLOOK

2.1. MARKET

DEFINITION

2.2. KEY

INSIGHTS

2.2.1. RELIABLE

PERFORMANCE OF LEAD—ACID BATTERIES INCREASES THEIR SALES

2.2.2. LOW

ENERGY DENSITY OF LEAD—ACID BATTERY REDUCES THEIR SELLING POTENTIAL

2.2.3. VRLA

BATTERIES ARE THE FASTEST-GROWING LEAD—ACID BATTERIES BY TYPE

2.3. EVOLUTION

& TRANSITION OF LEAD—ACID BATTERY

2.4. PORTER’S

FIVE FORCES ANALYSIS

2.4.1. THREAT

OF NEW ENTRANTS

2.4.2. THREAT

OF SUBSTITUTE

2.4.3. BARGAINING

POWER OF SUPPLIERS

2.4.4. BARGAINING

POWER OF BUYERS

2.4.5. THREAT

OF COMPETITIVE RIVALRY

2.5. KEY

IMPACT ANALYSIS

2.5.1. APPLICATION

2.5.2. COST

2.5.3. LIFE

SPAN

2.6. MARKET

ATTRACTIVENESS INDEX

2.7. VENDOR

SCORECARD

2.8. INDUSTRY

COMPONENTS

2.9. MARKET

DRIVERS

2.9.1. COMPARATIVELY

LOW COST

2.9.2. HIGH

SUSTAINABILITY AS COMPARED TO ALTERNATIVE PRODUCTS

2.9.3. GROWING

DEMAND FROM HYBRID ELECTRIC VEHICLES

2.10. MARKET

RESTRAINTS

2.10.1.

SLOWDOWN IN AUTOMOTIVE SECTOR

2.10.2.

INCREASING LEAD POLLUTION

2.11. MARKET

OPPORTUNITIES

2.11.1.

GROWTH OF OFF-GRID RENEWABLE

ENERGY GENERATION

2.11.2.

INCREASING USE OF SLA

BATTERIES IN DATA CENTERS

2.12. MARKET

CHALLENGES

2.12.1.

ADOPTION OF DRY BATTERIES

3. MIDDLE

EAST AND AFRICA LEAD—ACID BATTERY MARKET OUTLOOK – BY PRODUCT

3.1. SLI

BATTERIES

3.2. MICRO

HYBRID BATTERIES

4. MIDDLE

EAST AND AFRICA LEAD—ACID BATTERY MARKET OUTLOOK – BY TYPE

4.1. FLOODED

BATTERIES

4.2. ENHANCED

FLOODED BATTERIES

4.3. VRLA

BATTERIES

5. MIDDLE

EAST AND AFRICA LEAD—ACID BATTERY MARKET OUTLOOK – BY END-USER

5.1. AUTOMOTIVE

5.2. TELECOMMUNICATION

5.3. UPS

5.4. OTHERS

6. MIDDLE

EAST AND AFRICA LEAD—ACID BATTERY MARKET – REGIONAL OUTLOOK

6.1. UNITED

ARAB EMIRATES

6.2. TURKEY

6.3. SAUDI

ARABIA

6.4. SOUTH

AFRICA

6.5. REST

OF MIDDLE EAST & AFRICA

7. COMPETITIVE

LANDSCAPE

7.1. B.B.

BATTERY CO.

7.2. C&D

TECHNOLOGIES, INC. (ACQUIRED BY KPS CAPITAL PARTNER)

7.3. CROWN

BATTERY

7.4. CSB

BATTERY COMPANY LTD. (ACQUIRED BY HITACHI CHEMICAL ENERGY TECHNOLOGY)

7.5. EAST

PENN MANUFACTURING

7.6. ENERSYS

7.7. EXIDE

TECHNOLOGIES, INC.

7.8. GS

YUASA CORPORATION

7.9. CLARIOS

(FORMERLY JOHNSONS CONTROLS POWER SOLUTIONS)

7.10. NARADA

POWER SOURCE CO., LTD.

7.11. NIPRESS

7.12. NORTHSTAR

7.13. TOSHIBA

CORPORATION

7.14. ZIBO

TORCH ENERGY CO., LTD.

7.15. REEM

BATTERIES & POWER APPLIANCES CO. SAOC

8. RESEARCH

METHODOLOGY & SCOPE

8.1. RESEARCH

SCOPE & DELIVERABLES

8.2. SOURCES

OF DATA

8.3. RESEARCH

METHODOLOGY

TABLE 1: MIDDLE EAST

AND AFRICA LEAD—ACID BATTERY MARKET, BY COUNTRY, 2019-2027 (IN $ MILLION)

TABLE 2: BATTERY

TECHNOLOGY COMPARISON

TABLE 3: VENDOR

SCORECARD

TABLE 4: TECHNICAL

PERFORMANCE COMPARISON OF BATTERY

TABLE 5: WORLDWIDE

LITHIUM-ION BATTERY CAPACITY

TABLE 6: MIDDLE EAST

AND AFRICA LEAD—ACID BATTERY MARKET, BY PRODUCT, 2019-2027 (IN $ MILLION)

TABLE 7: MIDDLE EAST

AND AFRICA LEAD—ACID BATTERY MARKET, BY TYPE, 2019-2027 (IN $ MILLION)

TABLE 8: MIDDLE EAST

AND AFRICA LEAD—ACID BATTERY MARKET, BY END-USER, 2019-2027 (IN $ MILLION)

TABLE 9: MIDDLE EAST

AND AFRICA LEAD—ACID BATTERY MARKET, BY COUNTRY, 2019-2027 (IN $ MILLION)

FIGURE 1: RECYCLING

RATES-PERCENTAGE OF RECLAIMED MATERIAL IN UNITED STATES

FIGURE 2: TIMELINE OF

LEAD—ACID BATTERY

FIGURE 3: PORTER’S FIVE

FORCE ANALYSIS

FIGURE 4: KEY BUYING

IMPACT ANALYSIS

FIGURE 5: MARKET

ATTRACTIVENESS INDEX

FIGURE 6: INDUSTRY

COMPONENTS

FIGURE 7: ENERGY

CONSUMPTION BY BATTERIES IN MEGAJOULES PER KG

FIGURE 8: AVERAGE CO2

EMISSIONS PER KG BY BATTERY TECHNOLOGIES

FIGURE 9: MIDDLE EAST

AND AFRICA LEAD—ACID BATTERY MARKET, BY SLI BATTERIES, 2019-2027 (IN $ MILLION)

FIGURE 10: MIDDLE EAST

AND AFRICA LEAD—ACID BATTERY MARKET, BY MICRO HYBRID BATTERIES, 2019-2027 (IN $

MILLION)

FIGURE 11: MIDDLE EAST

AND AFRICA LEAD—ACID BATTERY MARKET, BY FLOODED BATTERIES, 2019-2027 (IN $

MILLION)

FIGURE 12: MIDDLE EAST

AND AFRICA LEAD—ACID BATTERY MARKET, BY ENHANCED FLOODED BATTERIES, 2019-2027

(IN $ MILLION)

FIGURE 13: MIDDLE EAST

AND AFRICA LEAD—ACID BATTERY MARKET, BY VRLA BATTERIES, 2019-2027 (IN $

MILLION)

FIGURE 14: MIDDLE EAST

AND AFRICA LEAD—ACID BATTERY MARKET, BY AUTOMOTIVE, 2019-2027 (IN $ MILLION)

FIGURE 15: MIDDLE EAST

AND AFRICA LEAD—ACID BATTERY MARKET, BY TELECOMMUNICATION, 2019-2027 (IN $

MILLION)

FIGURE 16: MIDDLE EAST

AND AFRICA LEAD—ACID BATTERY MARKET, BY UPS, 2019-2027 (IN $ MILLION)

FIGURE 17: MIDDLE EAST

AND AFRICA LEAD—ACID BATTERY MARKET, BY OTHERS, 2019-2027 (IN $ MILLION)

FIGURE 18: MIDDLE EAST

AND AFRICA LEAD—ACID BATTERY MARKET, REGIONAL OUTLOOK, 2018 & 2027 (IN %)

FIGURE 19: UNITED ARAB

EMIRATES LEAD—ACID BATTERY MARKET, 2019-2027 (IN $ MILLION)

FIGURE 20: TURKEY

LEAD—ACID BATTERY MARKET, 2019-2027 (IN $ MILLION)

FIGURE 21: SAUDI ARABIA

LEAD—ACID BATTERY MARKET, 2019-2027 (IN $ MILLION)

FIGURE 22: SOUTH AFRICA

LEAD—ACID BATTERY MARKET, 2019-2027 (IN $ MILLION)

FIGURE 23: REST OF

MIDDLE EAST & AFRICA LEAD—ACID BATTERY MARKET, 2019-2027 (IN $ MILLION)