Market By Product, Function, Deployment, End-user And Geography | Forecast 2019-2027

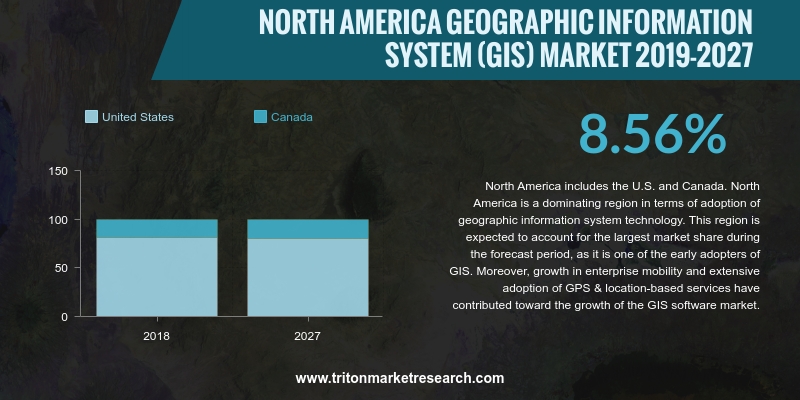

According to the research analysis by Triton, the North America geographic information system (GIS) market is expected to grow significantly in terms of revenue at a CAGR of 8.56% for the forecasting years 2019-2027.

Countries that have been covered in the geographic information system (GIS) market in North America are:

• The United States

• Canada

North America is predicted to capture the maximum market share, and as well become the fastest-growing region in the geographic information system market during the forecasted period, since it is a dominating region in terms of the adoption of GIS technology. An increase in the adoption of GPS & location-based services and enterprise mobility have been boosting the growth of the GIS market. Additionally, the defense, transportation & logistics, and utility sectors are anticipated to dominate the GIS market over the forecasting years. The convergence of technologies is another key factor that drives this market. However, the high costs and licensing issues restrain the market growth in the region.

Report scope can be customized per your requirements. Request For Customization

The geographic information system (GIS) market in the United States has been driving economic growth and helping private companies to gain economic benefits through the informed decision-making and reliable location analysis. Strategic initiatives taken by the satellite companies are driving the GIS market in the US. For instance, Spaceflight Industries acquired geospatial data firm OpenWhere as Spaceflight moves towards introducing its BlackSky satellite imaging business in 2017. Spaceflight Industries also raised a considerable amount to expand its micro-satellite launch business by supporting in sending the micro-satellites to space. This is expected to fuel the GIS market in the US.

Bentley Systems Inc. (Bentley Systems) is a software solutions provider that provides solutions for architects, engineers, fabricators, contractors, and planning. The company offers a wide range of software products that include building design, project delivery, structural detailing software, and site analysis. The company provides consulting, training, and project administration services. In 2019, the company announced its acquisition of Keynetix, which is a provider of geotechnical data management cloud services. The company operates in North and Latin America, Asia-Pacific, Europe, and the Middle East and Africa.

1. NORTH

AMERICA GEOGRAPHIC INFORMATION SYSTEM (GIS) MARKET - SUMMARY

2. INDUSTRY

OUTLOOK

2.1. MARKET

DEFINITION

2.2. KEY

INSIGHTS

2.2.1. NORTH

AMERICA DOMINATES THE OVERALL MARKET

2.2.2. GROWING

DEMAND FOR SERVICE SECTOR

2.2.3. INCORPORATION

OF GIS IN BUSINESS INTELLIGENCE

2.3. PORTER’S

FIVE FORCE ANALYSIS

2.3.1. THREAT

OF NEW ENTRANTS

2.3.2. THREAT

OF SUBSTITUTE

2.3.3. BARGAINING

POWER OF SUPPLIERS

2.3.4. BARGAINING

POWER OF BUYERS

2.3.5. THREAT

OF COMPETITIVE RIVALRY

2.4. MARKET

ATTRACTIVENESS INDEX

2.5. VENDOR

SCORECARD

2.6. MARKET

DRIVERS

2.6.1. RISE

IN ADOPTION OF GIS

2.6.2. INCREASING

DEMAND FOR SPATIAL DATA

2.6.3. DEVELOPMENT

OF SMART CITIES

2.7. MARKET

RESTRAINTS

2.7.1. HIGH

COSTS LEVIED ON GIS SOFTWARE

2.8. MARKET

OPPORTUNITIES

2.8.1. USE

OF GIS IN DISASTER MANAGEMENT

2.9. MARKET

CHALLENGES

2.9.1. STERN

RULES AND REGULATIONS

2.9.2. EASY

ACCESS OF OPEN SOURCE GEOGRAPHIC INFORMATION SYSTEM (GIS)

3. NORTH

AMERICA GEOGRAPHIC INFORMATION SYSTEM (GIS) MARKET OUTLOOK - BY PRODUCT

3.1. SOFTWARE

3.2. DATA

3.3. SERVICE

4. NORTH

AMERICA GEOGRAPHIC INFORMATION SYSTEM (GIS) MARKET OUTLOOK - BY FUNCTION

4.1. MAPPING

4.2. SURVEYING

4.3. LOCATION-BASED

SERVICES

4.4. NAVIGATION

AND TELEMATICS

4.5. OTHERS

5. NORTH

AMERICA GEOGRAPHIC INFORMATION SYSTEM (GIS) MARKET OUTLOOK - BY DEPLOYMENT

5.1. DESKTOP

GIS

5.2. SERVER

GIS

5.3. DEVELOPER

GIS

5.4. MOBILE

GIS

5.5. OTHERS

6. NORTH

AMERICA GEOGRAPHIC INFORMATION SYSTEM (GIS) MARKET OUTLOOK - BY END-USER

6.1. DEFENSE

6.2. AGRICULTURE

6.3. OIL

& GAS

6.4. CONSTRUCTION

6.5. UTILITIES

6.6. TRANSPORTATION

& LOGISTICS

6.7. OTHERS

7. NORTH

AMERICA GEOGRAPHIC INFORMATION SYSTEM (GIS) MARKET – REGIONAL OUTLOOK

7.1. UNITED

STATES

7.2. CANADA

8. COMPETITIVE

LANDSCAPE

8.1. HEXAGON

AB

8.2. ESRI

8.3. AUTODESK

INC.

8.4. BENTLEY

SYSTEMS INC.

8.5. GENERAL

ELECTRIC COMPANY

8.6. PITNEY

BOWES INC.

8.7. TRIMBLE

INC.

8.8. MACDONALD,

DETTWILER AND ASSOCIATES CORPORATION

8.9. CALIPER

CORPORATION

8.10. COMPUTER

AIDED DEVELOPMENT CORPORATION LIMITED (CADCORP)

8.11. SUPERMAP

SOFTWARE CO. LTD.

8.12. HI-TARGET

SURVEYING INSTRUMENT CO. LTD.

8.13. TAKOR

GROUP LTD

8.14. ATKINS.

8.15. FUGRO N.V

9. METHODOLOGY

& SCOPE

9.1. RESEARCH

SCOPE

9.2. SOURCES

OF DATA

9.3. RESEARCH

METHODOLOGY

TABLE 1: NORTH AMERICA

GEOGRAPHIC INFORMATION SYSTEM (GIS) MARKET, BY COUNTRY, 2019-2027 (IN $

MILLION)

TABLE 2: MARKET ATTRACTIVENESS

INDEX

TABLE 3: VENDOR SCORECARD

TABLE 4: NORTH AMERICA

GEOGRAPHIC INFORMATION SYSTEM (GIS) MARKET, BY PRODUCT, 2019-2027 (IN $

MILLION)

TABLE 5: NORTH AMERICA

GEOGRAPHIC INFORMATION SYSTEM (GIS) MARKET, BY FUNCTION, 2019-2027 (IN $

MILLION)

TABLE 6: NORTH AMERICA

GEOGRAPHIC INFORMATION SYSTEM (GIS) MARKET, BY DEPLOYMENT, 2019-2027 (IN $

MILLION)

TABLE 7: NORTH AMERICA

GEOGRAPHIC INFORMATION SYSTEM (GIS) MARKET, BY END-USER, 2019-2027 (IN $

MILLION)

TABLE 8: NORTH AMERICA

GEOGRAPHIC INFORMATION SYSTEM (GIS) MARKET, BY COUNTRY, 2019-2027 (IN $

MILLION)

FIGURE 1: NORTH AMERICA

GEOGRAPHIC INFORMATION SYSTEM (GIS) MARKET, BY PRODUCT, 2018 & 2027 (IN %)

FIGURE 2: PORTER’S FIVE FORCE

ANALYSIS

FIGURE 3: NORTH AMERICA

GEOGRAPHIC INFORMATION SYSTEM (GIS) MARKET, BY SOFTWARE, 2019-2027 (IN $ MILLION)

FIGURE 4: NORTH AMERICA

GEOGRAPHIC INFORMATION SYSTEM (GIS) MARKET, BY DATA, 2019-2027 (IN $ MILLION)

FIGURE 5: NORTH AMERICA

GEOGRAPHIC INFORMATION SYSTEM (GIS) MARKET, BY SERVICE, 2019-2027 (IN $

MILLION)

FIGURE 6: NORTH AMERICA

GEOGRAPHIC INFORMATION SYSTEM (GIS) MARKET, BY MAPPING, 2019-2027 (IN $

MILLION)

FIGURE 7: NORTH AMERICA

GEOGRAPHIC INFORMATION SYSTEM (GIS) MARKET, BY SURVEYING, 2019-2027 (IN $

MILLION)

FIGURE 8: NORTH AMERICA

GEOGRAPHIC INFORMATION SYSTEM (GIS) MARKET, BY LOCATION-BASED SERVICES,

2019-2027 (IN $ MILLION)

FIGURE 9: NORTH AMERICA

GEOGRAPHIC INFORMATION SYSTEM (GIS) MARKET, BY NAVIGATION AND TELEMATICS,

2019-2027 (IN $ MILLION)

FIGURE 10: NORTH AMERICA

GEOGRAPHIC INFORMATION SYSTEM (GIS) MARKET, BY OTHERS, 2019-2027 (IN $ MILLION)

FIGURE 11: NORTH AMERICA

GEOGRAPHIC INFORMATION SYSTEM (GIS) MARKET, BY DESKTOP GIS, 2019-2027 (IN $

MILLION)

FIGURE 12: NORTH AMERICA

GEOGRAPHIC INFORMATION SYSTEM (GIS) MARKET, BY SERVER GIS, 2019-2027 (IN $

MILLION)

FIGURE 13: NORTH AMERICA

GEOGRAPHIC INFORMATION SYSTEM (GIS) MARKET, BY DEVELOPER GIS, 2019-2027 (IN $

MILLION)

FIGURE 14: NORTH AMERICA

GEOGRAPHIC INFORMATION SYSTEM (GIS) MARKET, BY MOBILE GIS, 2019-2027 (IN $

MILLION)

FIGURE 15: NORTH AMERICA

GEOGRAPHIC INFORMATION SYSTEM (GIS) MARKET, BY OTHERS, 2019-2027 (IN $ MILLION)

FIGURE 16: NORTH AMERICA

GEOGRAPHIC INFORMATION SYSTEM (GIS) MARKET, BY DEFENSE, 2019-2027 (IN $

MILLION)

FIGURE 17: NORTH AMERICA

GEOGRAPHIC INFORMATION SYSTEM (GIS) MARKET, BY AGRICULTURE, 2019-2027 (IN $ MILLION)

FIGURE 18: NORTH AMERICA

GEOGRAPHIC INFORMATION SYSTEM (GIS) MARKET, BY OIL & GAS, 2019-2027 (IN $

MILLION)

FIGURE 19: NORTH AMERICA

GEOGRAPHIC INFORMATION SYSTEM (GIS) MARKET, BY CONSTRUCTION, 2019-2027 (IN $

MILLION)

FIGURE 20: NORTH AMERICA GEOGRAPHIC

INFORMATION SYSTEM (GIS) MARKET, BY UTILITIES, 2019-2027 (IN $ MILLION)

FIGURE 21: NORTH AMERICA

GEOGRAPHIC INFORMATION SYSTEM (GIS) MARKET, BY TRANSPORTATION & LOGISTICS,

2019-2027 (IN $ MILLION)

FIGURE 22: NORTH AMERICA

GEOGRAPHIC INFORMATION SYSTEM (GIS) MARKET, BY OTHERS, 2019-2027 (IN $ MILLION)

FIGURE 23: NORTH AMERICA

GEOGRAPHIC INFORMATION SYSTEM (GIS) MARKET, REGIONAL OUTLOOK, 2018 & 2027

(IN %)

FIGURE 24: UNITED STATES

GEOGRAPHIC INFORMATION SYSTEM (GIS) MARKET, 2019-2027 (IN $ MILLION)

FIGURE 25: CANADA GEOGRAPHIC

INFORMATION SYSTEM (GIS) MARKET, 2019-2027 (IN $ MILLION)